Road to Mainnet: Trader Joe

Learn more about the integration of Trader Joe, a leading DeFi protocol on Avalanche.

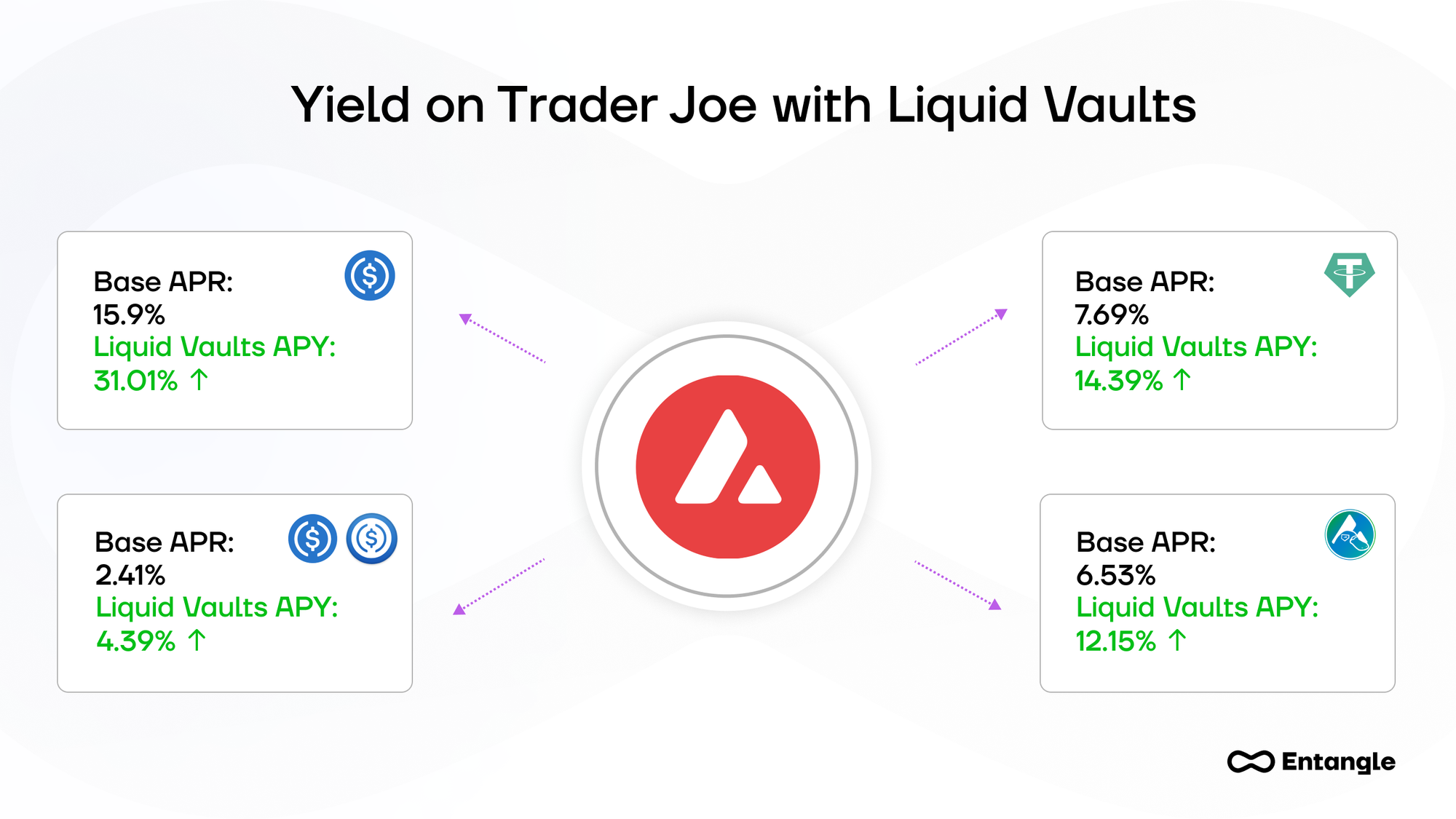

Entangle is pleased to announce the integration of its innovative dApp Liquid Vaults with the leading decentralized exchange, Trader Joe, an Avalanche-native AMM with $100M+ in TVL.

This partnership will increase the utility of Avalanche’s LP tokens, using Liquid Vaults to enable the minting of Liquid Staking Derivatives (LSDs) that are backed 1:1 by the underlying LP tokens.

Entangle’s’ LSDs can be used throughout DeFi, increasing yield and utility for users, while Trader Joe benefits from increased liquidity retention and capital efficiency. This in turn is supported by the Entangle Data Feeds, our low-cost, low-latency price feeds that connect Web2 and Web3 data in a fully customizable fashion.

Existing Challenges

In their current form, LP tokens from decentralized exchanges have limited utility. They cannot be refinanced, and users are often faced with the opportunity cost in holding these tokens compared to holding other positions. DeFi ecosystems and projects are in a continuous struggle to capture and retain the available liquidity in the network. As a result, liquidity retention is often seen as one of the key challenges to overcome in the crypto space.

Despite yield being generated from a platform’s trading fees, this yield often doesn’t outweigh the impermanent loss that is incurred, but holders have few alternatives pin the current system.

Increasing the composability and utility of LP tokens will increase their yield and incentivizes holding these tokens, which benefits both users and protocols alike.

User Benefits

By locking up Trader Joe LP tokens, Avalanche users can mint the equivalent value of LSDs. These are backed 1:1 by the underlying token and can be used throughout the rest of DeFi.

These LSDs provide a number of benefits to holders, including:

- Enhanced yield: LSDs can be refinanced and deployed elsewhere while still earning on the underlying yield.

- Auto-compounding: Yield on the underlying LP tokens is automatically compounded, increasing returns.

- Leveraged Farming: Refinancing LSDs to earn leveraged liquidity pool returns.

- Cross-chain Strategies: Yield aggregation and other cross-chain strategies to further increase yield and asset utility.

For example, once the LP tokens have been converted to LSDs, they can be lent out on a separate protocol, boosting earned yield. Alternatively, they could be used for leveraged farming or cross-chain farming allowing users to find the best returns available across 15 chains, while the underlying LP tokens continue to gain value by compounding any yield received on Trader Joe.

Trader Joe Benefits

This integration also greatly benefits Trader Joe by increasing their liquidity retention and creating synergies with other DeFi protocols.

In particular, they benefit Trader Joe in 3 key ways:

- Enhanced Utility of Trader Joe's LP Tokens: By staking their LP Tokens with Liquid Vaults, users receive LSDs that unlock a range of new DeFi possibilities

- Liquidity Retention: Users are no longer forced to choose between holding their LP tokens or seeking yield elsewhere. LSDs increase capital efficiency and yield while enabling users to do both.

- Liquidity Sharing: Protocols can share liquidity amongst themselves. For example, Trader Joe’s LP tokens could be converted to their LSD counterparts and used in Avalanche lending & borrowing protocols.

Conclusion

The partnership between Entangle and Trader Joe is a game-changer in the DeFi space, particularly for holders of Avalanche LP tokens. Trader Joe will be able to significantly enhance the utility and yield potential of LP tokens, through the minting of LSDs through Liquid Vaults. This addresses the current limitations of LP tokens, providing users with lucrative options like enhanced yield through refinancing, auto compounding, and innovative cross-chain strategies.

This Trader Joe integration is just the beginning, with many additional upcoming partnerships, and plans to expand beyond LP tokens. Entangle’s goal is to optimize and unify liquidity for all DeFi assets with the Composable Derivative Tokens. Alongside our interoperability infrastructure that seamlessly connects various EVM and non-EVM networks, Entangle is reshaping the future of DeFi.

Those interested in learning more can visit our website or follow us on Twitter to stay up-to-date.