Entangling BRC-20

What is BRC-20?

BRC-20 represents an experimental fungible token standard that leverages ordinal inscriptions within the Bitcoin network. The question arises as to whether Bitcoin should exclusively function as digital gold or if it should encompass more intricate capabilities such as smart contracts. The introduction of ordinal NFTs has spurred a renewed interest in Bitcoin, particularly in establishing fungible tokens directly on the Bitcoin platform, epitomized by the BRC-20 standard.

BRC-20 tokens present an innovative solution to overcome the inherent programmability limitations of Bitcoin, enabling the creation of semi-fungible tokens through the utilization of ordinal inscriptions. BRC-20 tokens extend operational mechanics to the Bitcoin Network, with potential to form a standardized token framework within the Bitcoin ecosystem.

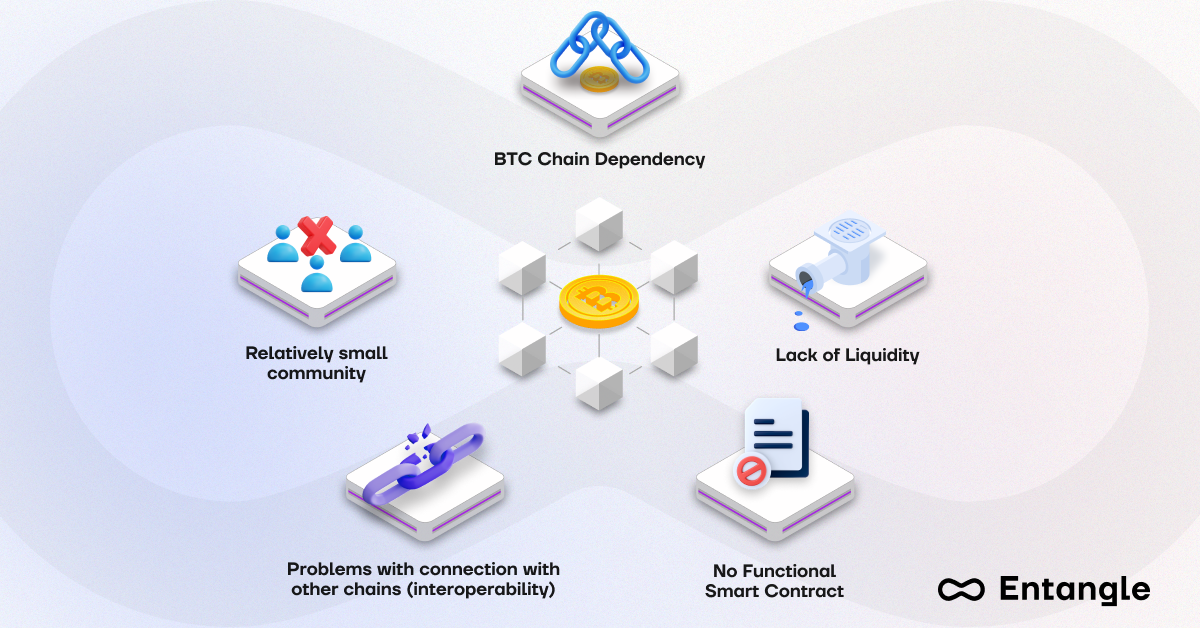

However, there are certain limitations within the design of BRC-20 and the lack of ability to connect to realms outside of Bitcoin. The following examples illustrate this in some more detail:

Relatively small developer community

In contrast to widely adopted token standards such as ERC-20, the BRC-20 standard boasts a smaller community of developers. The modest size of this developer cohort has the capacity to impede the rate of technological advancements within the standard.

Limited interoperability

The BRC-20 token standard was custom-designed to operate exclusively within the Bitcoin blockchain ecosystem. This design choice presents interoperability challenges, especially for users seeking to engage with different blockchain systems. Interoperability across chains holds significance as it enables smooth token transfers throughout the cryptocurrency ecosystem, bridging various blockchain networks.

In addition, liquidity is limited as a result due to the lack of access diversity of users of different networks. As a result, limited product creativity due to the lack of liquidity….

No smart contract functionality

Unlike other token standards, such as the Ethereum network’s ERC-20 standard, the BRC-20 standard lacks support for smart contracts. These pieces of code, which are based on blockchain technology, expand the range of functionalities available on chains that are compatible with them.

Dependency on the Bitcoin blockchain

The BRC-20 standard relies on the Bitcoin blockchain, exposing it to the inherent constraints of the network. These limitations involve challenges such as limited scalability and sluggish transaction speeds. As the utility of the BRC-20 blockchain grows and congestion intensifies, these issues are expected to become more pronounced. Significantly, there has been a notable deterioration in network congestion since the introduction of the standard, resulting in a surge of Bitcoin transactions.

Over the past few months, millions of transaction records have been generated, with the count steadily rising. This surge has led to prolonged transaction processing times on the Bitcoin blockchain and a substantial spike in network fees. As a result, the efficiency and cost-effectiveness of BRC-20 token transfers are expected to suffer adverse effects as this issue persists.

Limited utility

Primarily designed for the tokenization of fungible assets, the BRC-20 standard is unsuitable for the tokenization of nonfungible assets or the implementation of complex token features such as tokenized ownership rights or conditional transfers.As such, projects that necessitate more specialized tokenization functionalities that go beyond the BRC-20 standard’s capabilities are likely to seek more feature-rich token standards.

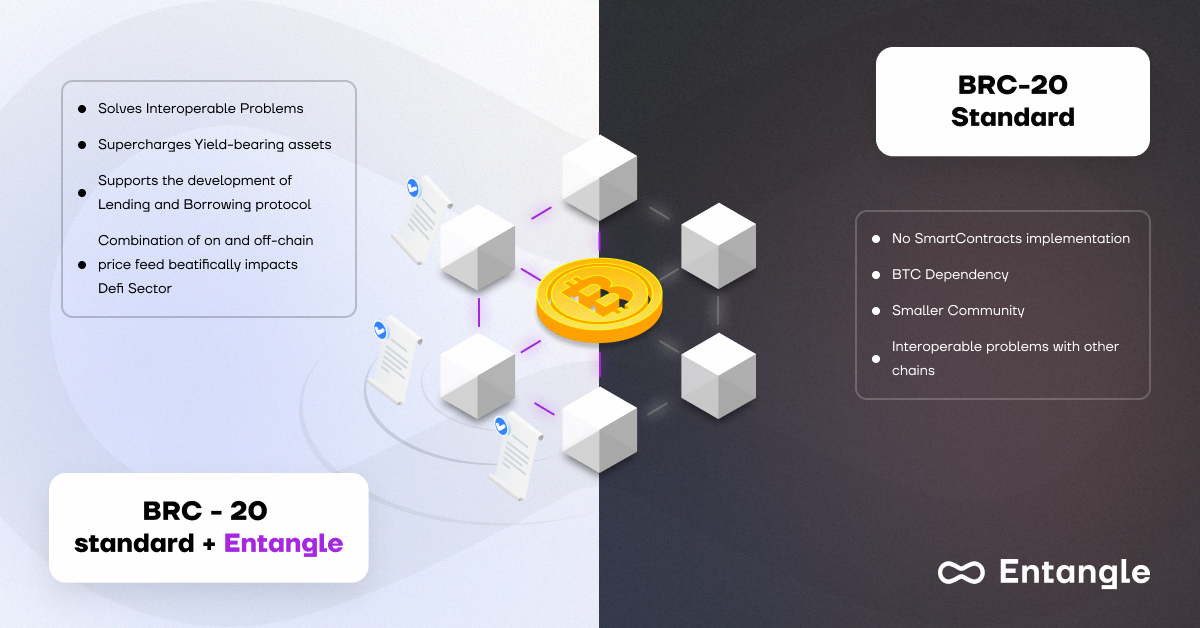

Use cases of Entangle and its impact on BRC-20

De-Fi in a “cohesion” with BRC20 standard

As the name already suggests, most BRC-20 standardized tokens can be great collateral to form the basis of synthetic assets to be leveraged for lending and borrowing protocols.Entangle can support the re-staking, refinancing and collateralisation of any BRC-20 yield-bearing assets.

Chamcha (liquidity-building and yield protocol for BRC20s)

Use-case: A user can use their assets on the BRC20 chain and stake them into Liquidity Pool on the Chamcha protocol. Then, Liquid Vaults allow users to auto-stake LP tokens and, in return, receive a 1:1 backed composable LSD, reflecting the staked value of the underlying LPs.

Dova (a BRC20 lending protocol)

Use-case: When users stake their LP tokens via Entangle, they receive 1:1 composable (LSDs), which can now support as collateral and a lending asset, thereby enabling users to unlock additional token utility!

Multibit (a bridge for BRC20 tokens from Bitcoin to EVM)

MultiBit stands out as the pioneer in creating a dual-sided bridge tailored for BRC20 and ERC20 tokens. By prioritising unmatched liquidity, MultiBit plays a pivotal role in enhancing cross-chain interoperability.

Use Case: Entangle can support “bridging” platforms with our native Photon Messaging Layer (protocol)

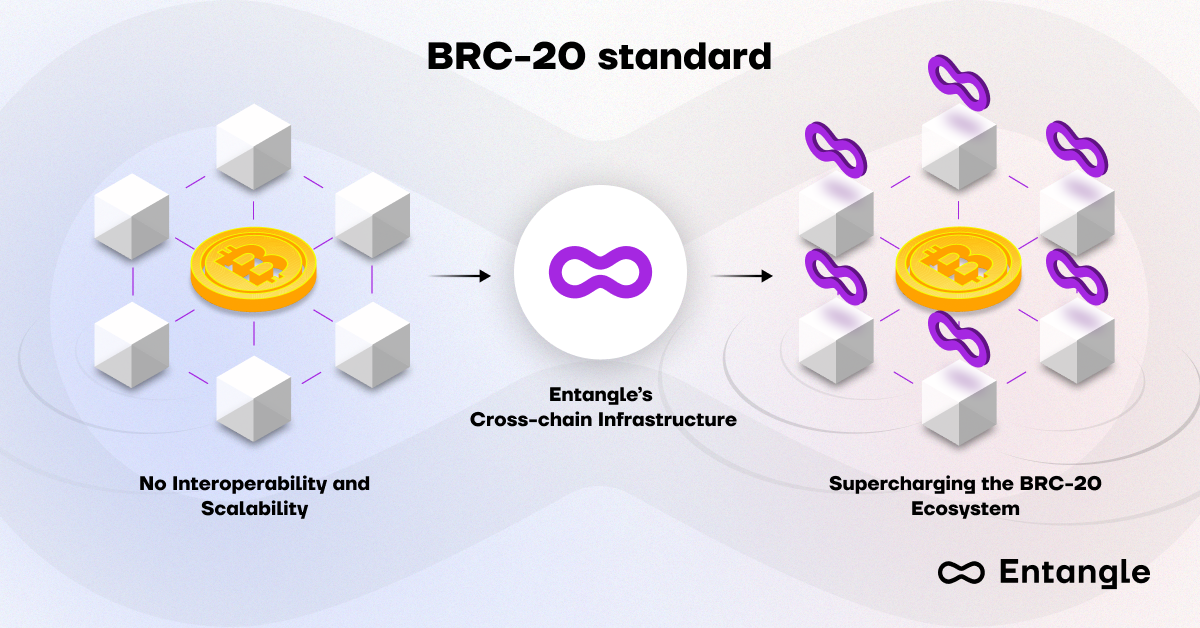

As discussed, BRC-20 needs enabling to connect with other chains. Without robust smart contract implementation, Entangle can play an essential role in providing the infrastructure that BRC-20 requires in order to allow interoperability across other blockchains.

Entangle is set to offer a cross-chain infrastructure, enabling the creation of transfer/mint/burn bridges for BRC20 tokens between BTC and both EVM and non-EVM blockchains.

This innovation will allow for the implementation of BRC20 tokens as wrappers on these blockchains, enhancing their utility enabling them to be utilized as ERC20 tokens. Such utility could be realized in the formation of markets via liquidity pools on DEXs or in Lending & Borrowing Protocols.

The transfer/mint/burn bridge involves users transferring their BRC20 tokens to a specialized Vault. When doing so, they include a message specifying the target chain and address where a corresponding wrapper token should be created.

This Vault is governed by a Threshold Signature Scheme (TSS) involving the Entangle Transmitter Agents. These agents play a critical role in securely relaying deposits to facilitate the minting of wrapper tokens on other blockchains.

Additionally, when wrapped BRC20 tokens from other blockchains are set to be burned, they are transferred back from the BTC-based Vault to the designated address as required. This ensures a secure and efficient cycle of token wrapping and unwrapping across various blockchain platforms.

Entangle is poised to revolutionise ecosystems such as BRC-20 and will be collaborating with projects in this space in the near future.