Liquid Restaking Tokens (LRTfi)

What is Restaking

Restaking revolutionizes blockchain efficiency by allowing users to stake tokens on multiple networks simultaneously, increasing the rewards to stakers at the cost of an increased risk of having their stake slashed. Developed by EigenLayer, it uses Liquid Restaking Tokens (LRT) to optimize the utility of staked tokens, benefiting both stakers and networks. This novel use case is gaining momentum as more projects explore its applications and potential to enhance the … of resources.

In blockchain security, particularly Proof of Stake (PoS) systems, restaking emerges as a way to activate dormant staked tokens. With staking users can play their part in enhancing network security by locking assets with a validator node. Restaking protocols like EigenLayer allow these locked tokens to then be used across various networks, extending Ethereum's trust network and negating the need for separate validator sets.

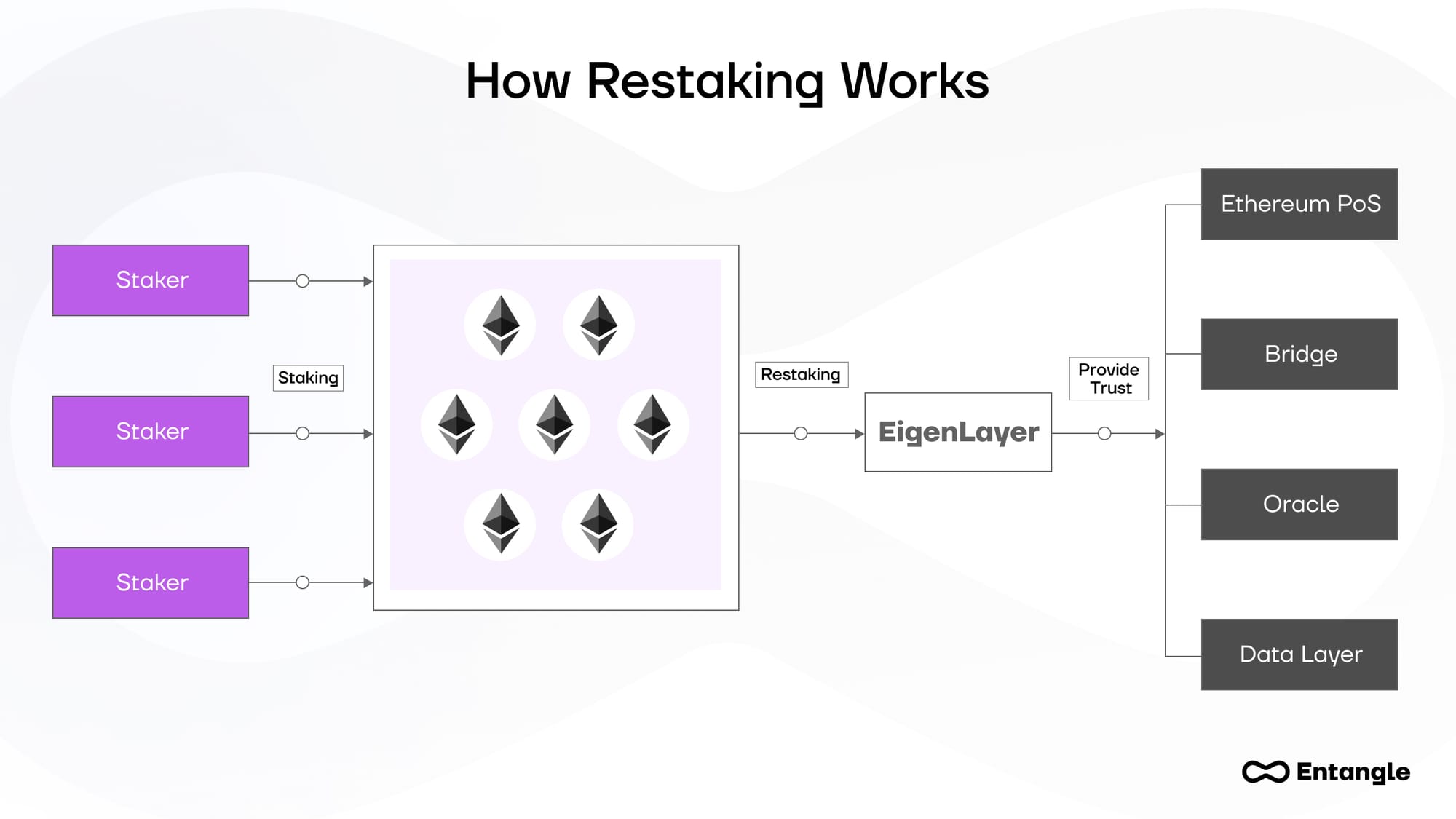

How Restaking Works

Restaking lets users stake coins on both the main network and on other protocols at the same time, securing them all. In EigenLayer's native restaking, Ethereum validator node operators manage the assets through smart contracts which determine the specific software and slashing conditions. Alternatively, liquid restaking allows users to exchange staked assets with a validator for Liquid Staking Tokens (LST), which are then restaked on the protocol. Currently, EigenLayer has paused liquid restaking.

After depositing in a restaking protocol, users can then re-stake through EigenLayer's dApps, known as Actively Validated Services (AVSs), earning additional rewards for supporting multiple protocols. While this system is designed to support various advanced services, these options are not yet available for restaking.

Benefits of Restaking

Restaking offers significant benefits, including improved rewards for stakers where yields can be well in excess of the standard 3.6% from solo staking on Ethereum. It's particularly advantageous for new protocols and networks, providing a cost-effective way to bolster security by accessing a wider pool of validators.

Additionally, restaking enables scalable security, allowing protocols to adjust their security level based on demand, ensuring both flexibility and cost-efficiency in network security management.

Challenges in Restaking for Liquidity Pools

In the cryptocurrency ecosystem, Liquidity Provider (LP) tokens are issued to those who deposit assets into liquidity pools on Decentralized Exchanges (DEXs), representing their share in the pool and entitlement to a portion of trading fees. While facilitating efficient token swaps on DEXs and earning yield from staking, these LP tokens face a significant challenge: the absence of further restaking opportunities.

Once staked, the utility and user engagement with LP tokens typically conclude, highlighting a gap in the decentralized finance sector for enhanced utility and lifecycle of these tokens.

A New Method of Restaking

Entangle is at the forefront of enhancing the utility of LP tokens, having developed the pioneering solution to restake these assets for further use. Recognizing the untapped potential of over $14 billion in idle LP tokens in the market, Entangle's Liquid Vaults transforms them into composable Liquid Staking Derivatives (LSDs), opening a new realm of possibilities for LSD applications.

Liquid Vaults, Entangle's native decentralized application (dApp), optimizes liquidity across 11 blockchains by refinancing yield-bearing assets. This is acheived through 1:1 asset backed LSDs, powered by Entangle’s Universal Data Feeds. This innovation not only enhances liquidity but also opens up a host of wider uses for these assets, including restaking in derivatives protocols.

Moreover, Liquid Vaults acts as a bridge for real-world assets, allowing them to be synthesized while maintaining their composability and transferability across multiple ecosystems. Users benefit by depositing their LP tokens into the Liquid Vaults dApp, which can then be used as collateral to borrow against, all while continuing to earn yield on the underlying asset.

Furthermore, Liquid Vaults facilitates liquidity sharing among dApps within any Entangle-connected ecosystem. This solves the challenge of liquidity being a zero-sum game, especially when specific dApps gain popularity on a chain. Liquid Vaults levels the playing field, using the composability of liquidity positions as a foundation for sharing resources between applications, thus enhancing the overall liquidity and efficiency of the ecosystem.