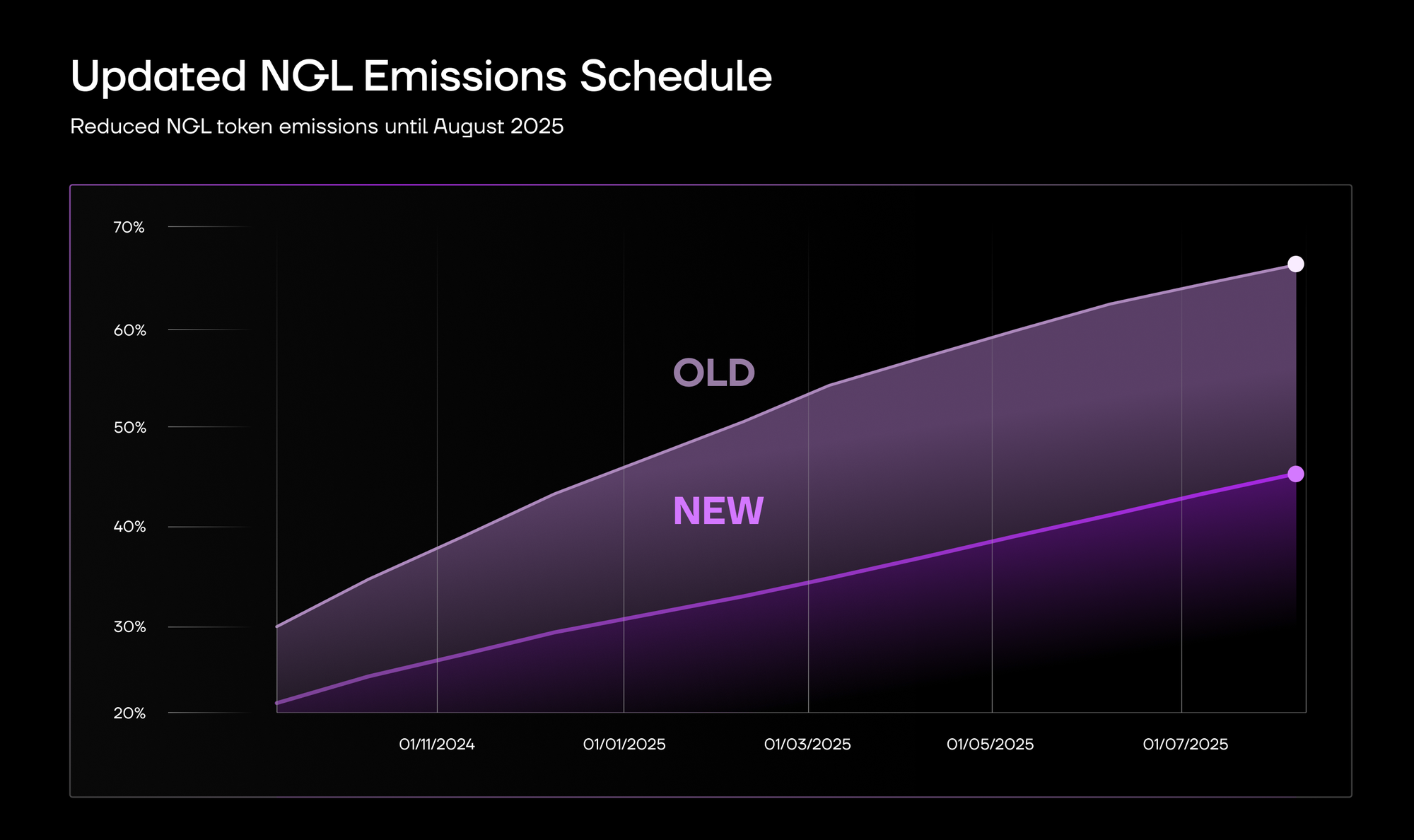

$NGL Tokenomics and Emission Schedule Update

Learn more about the reduction in $NGL emissions and team tokens.

Having heard the community's concerns surrounding the token’s recent price performance, and following consultations with select industry experts, major investors and communities, we have arrived at the conclusion to amend the vesting and distribution schedule to demonstrate utmost transparency to the project, communities, investors and more.

The updated unlock/emission schedule for $NGL will see reduced inflation and longer vesting schedules for team, advisors and early investors as part of a strong drive to increase resilience and sentiment. As part of the revised tokenomics, a quarter of the allocation previously reserved for the team will now be burnt with the remaining locked up for lengthier periods, and tokens destined for liquidity are being locked to reduce circulating supply and showcase commitment to the ecosystem.

Periodic burns are already taking place to ensure that emissions don't inflate the total supply, with the third such burn being announced here.

The new changes to the emission schedule are as follows:

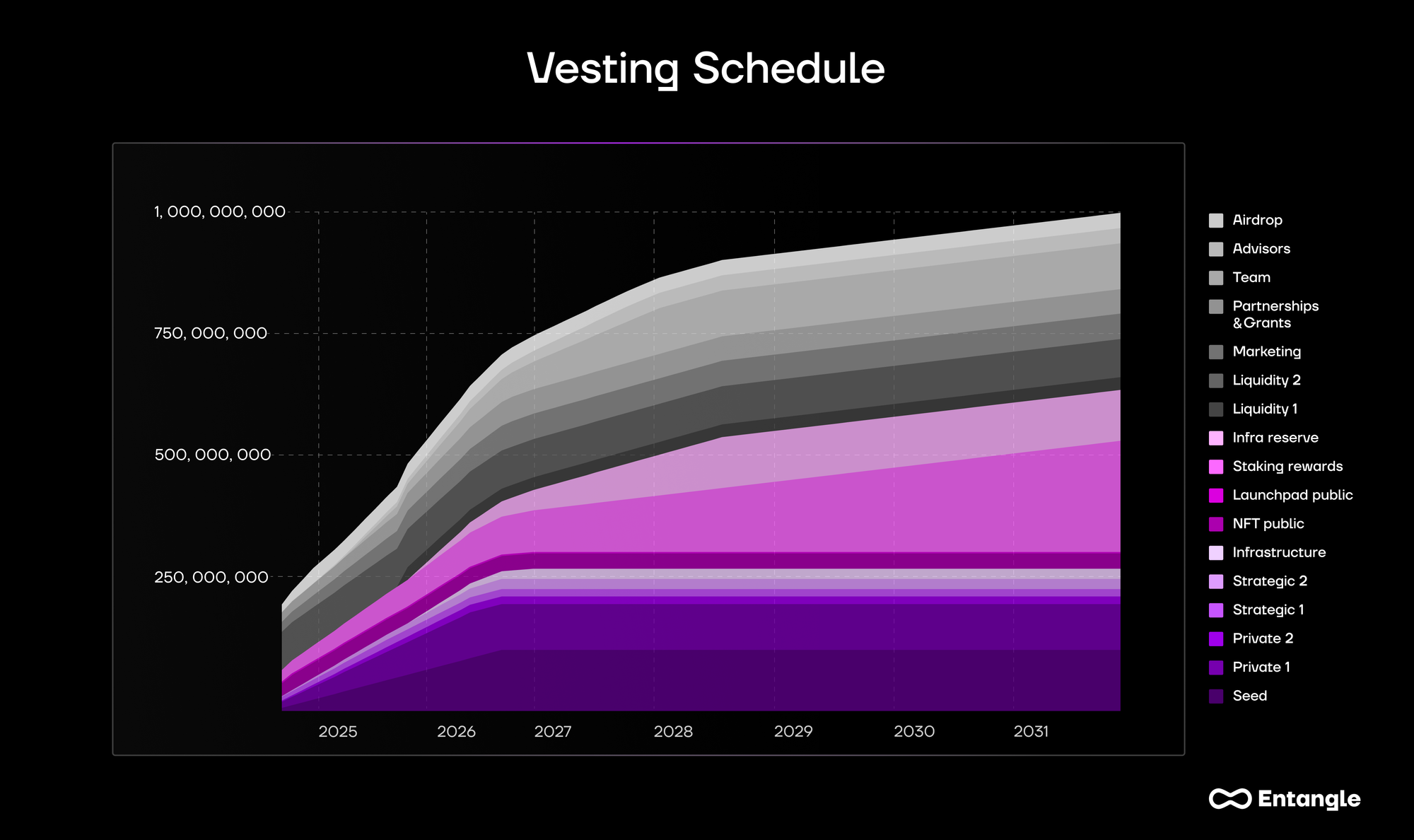

Team

Cliff: 12 month; Vesting: 30 months

Always putting the community and the project at the forefront of everything we do, the team allocation will be reduced from the original distribution of 12% to 9%.

An additional 6 months has been added to both the cliff and vesting period.

For enhanced transparency, the team allocation will be bridged to Ethereum so that it is searchable in any EVM explorer. We are in discussions with CoinGecko and Coinmarketcap on the matter and will provide updates in due course.

3% of the Team Allocation will be burnt on 19th July reducing the circulating supply forever.

Advisors

Cliff: 9 month; Vesting: 30 months

Advisors are now subject to an additional 3 months cliff and 6 months vesting on their tokens.

Staking Rewards

Vesting: 86 months

The schedule for the emission of staking rewards will be almost doubled to just over 7 years from 3.5.

These are utilised to both offset inflation and ensure a sustainable reward program for stakers, validators and agents. This change will be visible on the ethereum side on EVM explorers from Thursday, July 25th.

As well as reducing emissions greatly, this step showcases our long term conviction to the development of the ecosystem.

Liquidity

2.5% Locked; 7.5% Liquidity remaining.

25 million $NGL will be locked in a smart contract (multisig) for one year on 23.07.2024.

The remaining 7.5% is ring fenced for Omnichain liquidity deployments and liquidity for both CEXs and DEXs as Entangle’s tech stack is integrated into ever more Blockchains.

Marketing

Vesting: 24 months

The marketing budget is now subject to an additional 12 months of vesting, requiring the team to focus their efforts on avenues providing the greatest returns in this attention economy.

Grants and Partnerships

Vesting: 24 months

The allocation for the development of Grants and Partnerships is now vesting over a further 12 months, allowing for greater flexibility as we build over the coming years and attract incubations, projects and innovation on our omnichain tech stack.

Seed and Private Rounds

Seed - Cliff: 6 month; Vesting: 21 months

Private - Cliff: 6 month; Vesting: 18 months

All presale rounds are now subject to an additional 2 to 3 months cliff and an added 6 month vesting on tokens, reducing the daily emissions.

Strategic Round 1

Cliff: 4 month; Vesting: 12 months

The distribution for the allocation for content creators (KOLs) was already amended to a 4 month cliff shortly after TGE (initially 1 month). The vesting schedule was also extended by 4 months. We expect to work closely with our partners in alignment of the strategic goals and enhancing visibility of the project.

Strategic Round 2

Cliff: 6 month; Vesting: 21 month

Allocations for this round now also have an additional 2 months cliff and 6 months vesting added.

Airdrop & Infra Reserve

No change

The community allocations for Webverse stakers, $NGL staking rewards and Infrastructure allocations for validators remain unchanged.

The community is the backbone of any Web3 project and for now this remains unchanged. We expect our community to recognise the long term opportunity here and partake in the multitude of incentives available for stakers of NGL.

Distribution for the Omnichain Era

These changes to the emission schedule are being introduced with the aim of both reducing the inflation rate and the circulating supply. The adjustments mean there will be no token distributions for advisors or the team until March 2025, and all other presale tokens will now have a lower emission rate.

By burning 25% of the Team allocation, permanently reducing the circulating supply by 3%, as well as locking the 2.5% of the supply earmarked for liquidity for a period of one year, $NGL tokenomics now demonstrate the robustness required to underpin the infrastructure making omnichain easy.