Road to Mainnet: Ajna Finance

Learn more about Entangle's strategic partnership with Ajna Finance

Entangle is pleased to announce its partnership with Ajna, a permissionless borrowing and lending protocol.

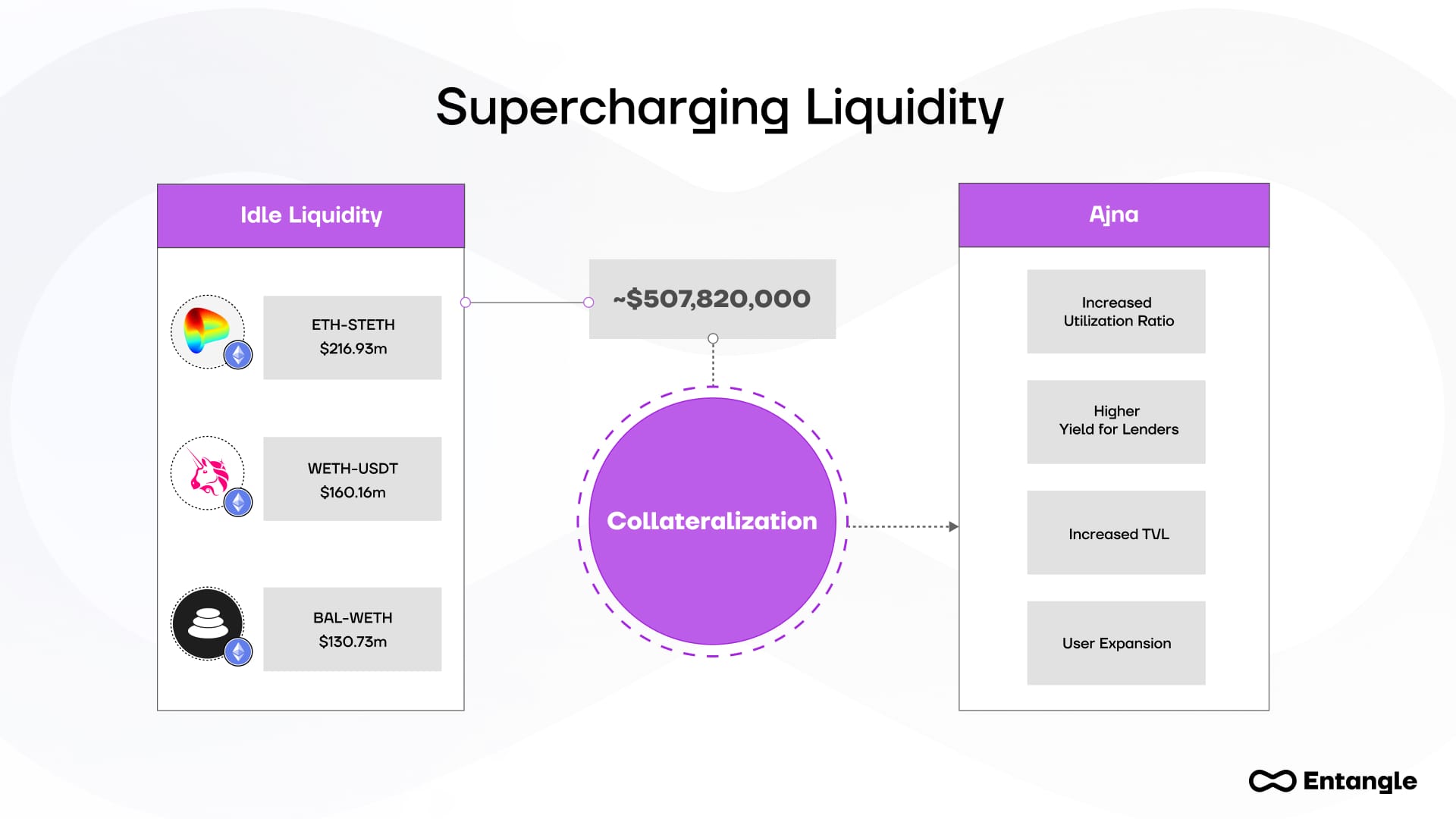

This partnership will integrate Entangle’s Liquid Staking Derivatives (LSDs) with Ajna, increasing ecosystem-wide liquidity and boosting user yields. LSDs refer to wrapped, composable versions of yield-bearing assets (such as LP tokens) enabled through Entangle’s native application Liquid Vaults.

Entangle and Ajna

Ajna is a borrowing and lending protocol on Ethereum and various Layer 2s, including Arbitrum, Polygon, and Base. Key distinctions from other lending protocols include immutable smart contracts, leveraged borrowing, uncapped pools (no max lending/borrowing amounts), liquidation bonds, NFT loans, and oracle-free pricing.

Entangle’s partnership with Ajna will make Entangle’s LSDs compatible with Ajna, allowing for the cross-protocol collateralization of yield-bearing assets.

For example, one’s LP position on Ethereum (or another supported network) could be converted into an LSD. It could then be lent out on Ajna, with the holder not only earning on their underlying LP position but also earning on their lent assets. They could then borrow funds from Ajna (using their lent assets as collateral), further boosting yield.

Benefits

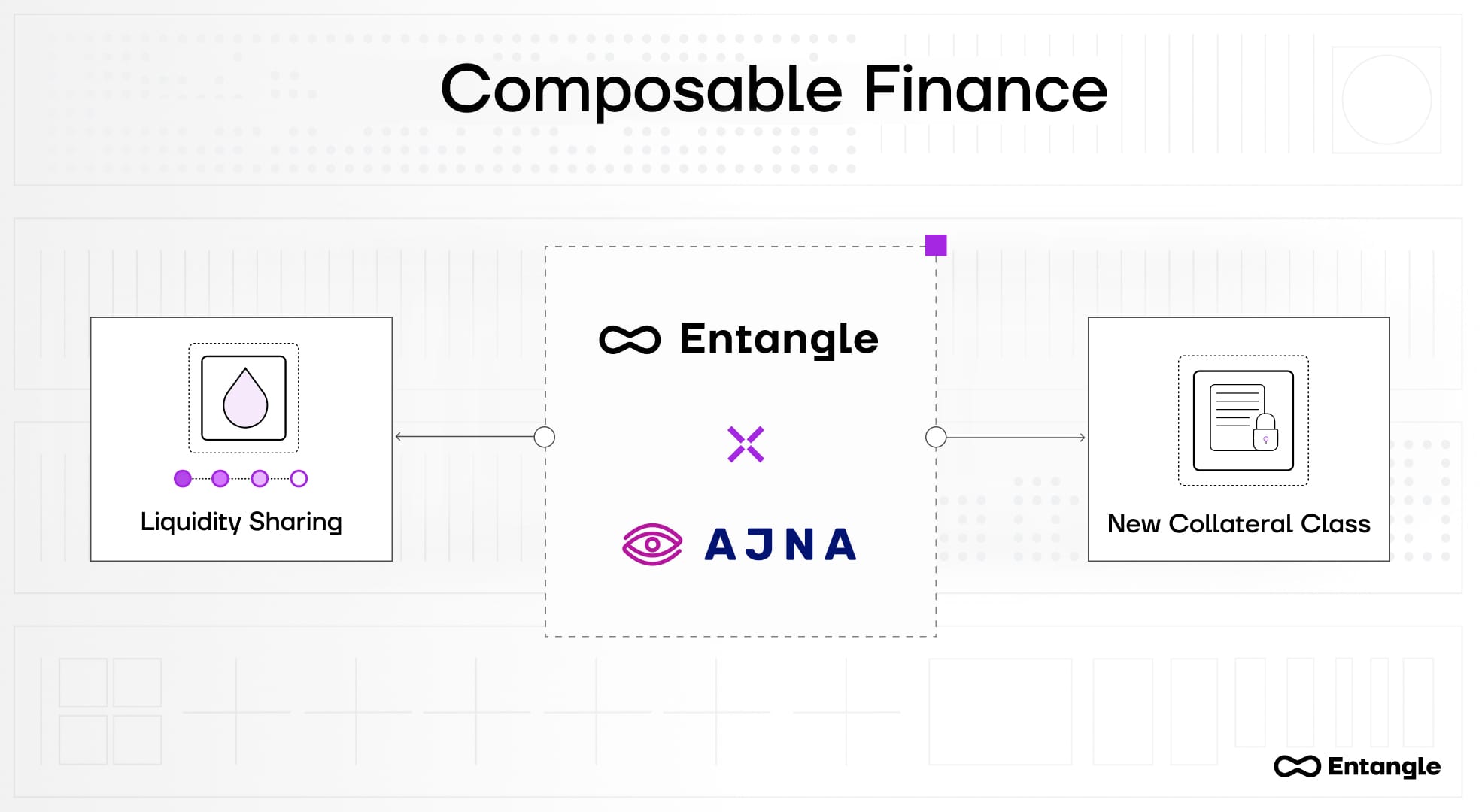

This integration delivers substantial benefits for both Ajna and its users. For Ajna, it enhances composability within the broader DeFi landscape and broadens the range of accepted assets, thereby fostering greater liquidity sharing across the ecosystem. Moreover, it bolsters platform liquidity, incentivizing retention and drawing in a larger user base.

On the user side, DeFi participants can optimize capital efficiency through asset refinancing while continuing to earn from their underlying positions. As additional protocols integrate with Entangle’s Liquidity Sharing Devices (LSDs), users gain expanded capabilities to leverage their yield-bearing assets.

Conclusion

DeFi is rapidly evolving into a unified, interoperable ecosystem where liquidity can seamlessly flow across chains. The partnership between Entangle and Ajna represents a significant step forward in this journey, enriching the utility of yield-bearing assets. This enhancement, in turn, amplifies liquidity, composability, and yield opportunities for all users.

Those interested in learning more can visit our website or follow us on Twitter to stay up-to-date.