Road to Mainnet: Timeswap

Learn about Entangle's integration with Timeswap.

Entangle is thrilled to unveil its latest partnership with TimeSwap, a move that will seamlessly integrate Entangle's Liquid Staking Derivatives (LSD’s) into the TimeSwap ecosystem.

LSD’s represent composable versions of yield-bearing assets, including LP tokens, made possible through Entangle's native application Liquid Vaults. This collaboration will not only bring increased utility and composability to liquidity currently on TimeSwap and composability to TimeSwap, but will also significantly enhance liquidity across the entire ecosystem while enhancing user yield.

Entangle x Timeswap

TimeSwap is the first oracleless lending and borrowing protocol, enabling the creation of money markets using any form of ERC-20 asset. It is currently live on Ethereum, as well as various Layer 2 networks such as Arbitrum, Mantle, Polygon, and Base.

Key differentiators include:

- Oracle-free pricing

- Non-liquidatable loans

- Fixed-term loan durations

- Flexible withdrawals

- Immutability

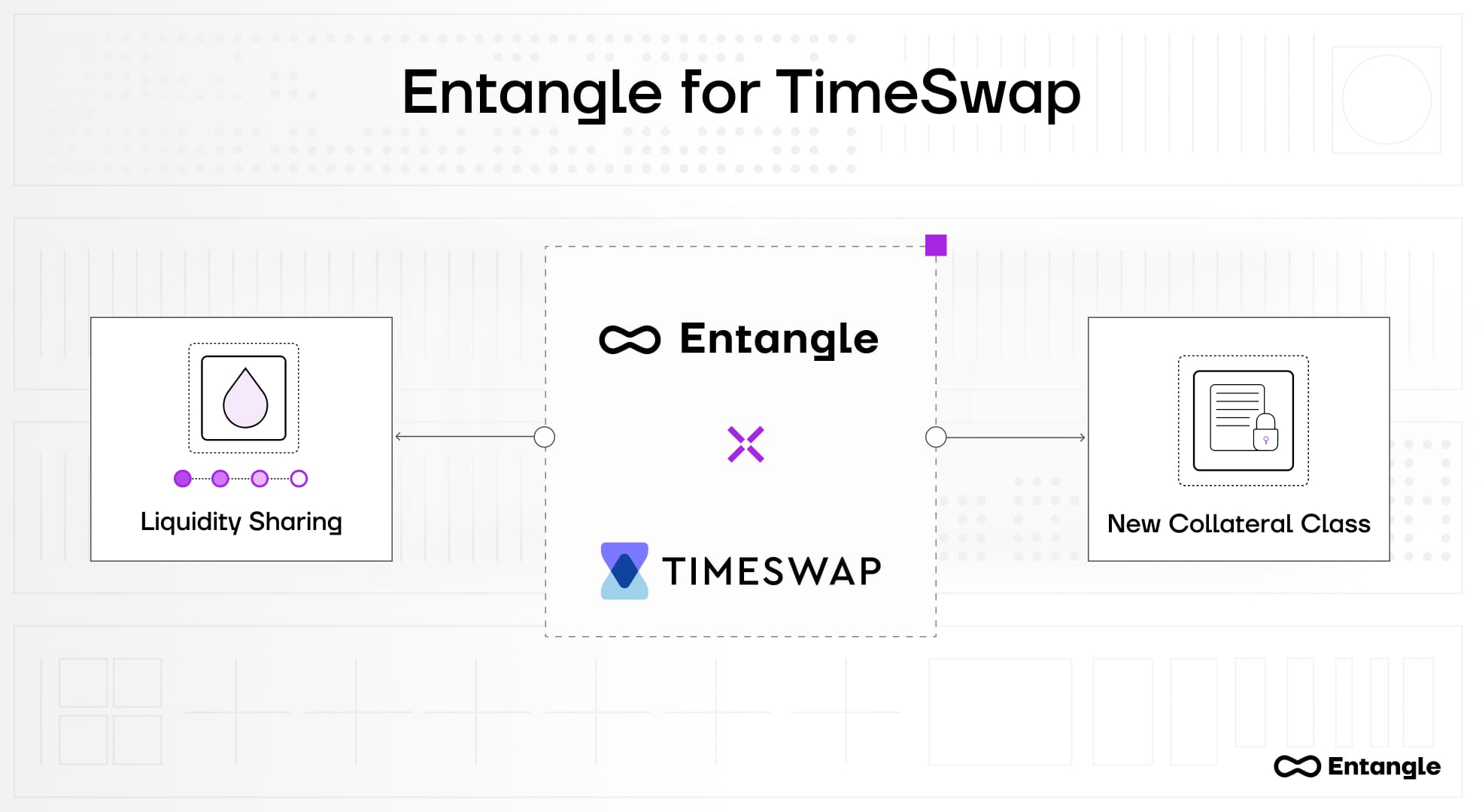

Entangle’s partnership with TimeSwap will make Entangle’s Liquid Vaults compatible with TimeSwap, allowing ecosystem-wide asset collateralization.

Benefits

This integration brings substantial advantages to both TimeSwap and its users.

For TimeSwap, it increases composability with the rest of DeFi and expands potential asset acceptance, in turn fostering ecosystem-wide liquidity sharing. It also increases platform liquidity, incentivizing liquidity retention and attracting a larger user base.

On the other hand, DeFi users can maximize their capital efficiency through asset refinancing, while continuing to earn from their underlying positions. As more protocols integrate with Entangle’s LSD’s, users will be able to do even more with their yield-bearing assets.

Conclusion

DeFi is moving towards a unified, interoperable ecosystem where liquidity can be seamlessly shared. The partnership between Entangle and TimeSwap marks a significant milestone on this journey, increasing the utility of yield-bearing assets. This in turn increases liquidity, composability, and yield opportunities for users.

Those interested in learning more can visit our website or follow us on Twitter to stay up-to-date.