Solana Omnichain Use Cases

Connecting your favourite chains to your dApp.

Interoperability is a key challenge in blockchain. As ecosystems develop unique strengths, seamless interaction becomes vital. At Entangle, we are committed to building a cohesive omnichain ecosystem that facilitates frictionless interaction across chains.

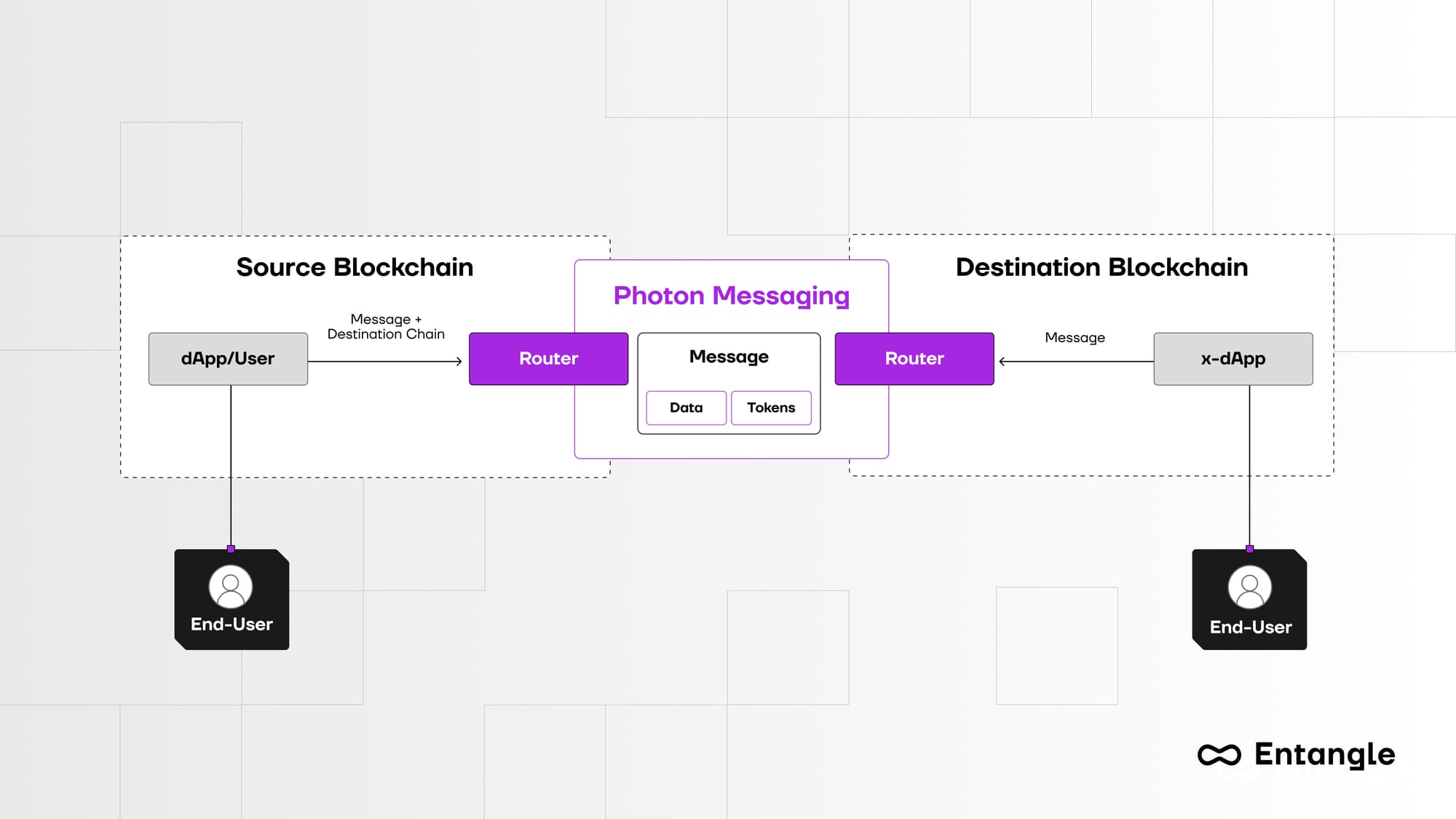

The e-Bridge and Photon Messaging are crucial to Entangle’s Omnichain solution, enabling asset and message flow across ecosystems and connecting dApps with external blockchains. Our integrations with Ethereum, Mantle, BASE, and BNB Chain already demonstrate this interconnected potential.

With the onboarding of Solana, the largest non-EVM chain, Entangle has bridged EVM and non-EVM environments, showcasing the true capabilities of our omnichain infrastructure. We will present multiple use cases demonstrating innovative solutions such as unified liquidity pools, native asset deployments, and omnichain gaming.

Unified Liquidity Pools

Liquidity is the core of DeFi, encompassing DEXs, lending platforms, and other derivatives. Only with ample liquidity can traders maximize their strategies without being hindered by slippage. Over the past year, the trading volume and liquidity of Solana have surpassed Uniswap on Ethereum multiple times, especially during memecoin surges.

Jupiter is the largest DeFi platform on Solana, aggregating most of the liquidity in the Solana ecosystem. If they could unify liquidity from Ethereum and other EVM chains, they have the potential to become the largest cross-chain DeFi platform.

The challenge here is that liquidity pools are fragmented, a problem that has persisted throughout DeFi’s existence. Developers are exhausted from integrating with new chains and rollups due to differences in technical architecture.

Entangle’s Photon Messaging is complemented by Universal Data Feeds (UDF), a novel oracle service that incorporates both on-chain and off-chain data. This combination establishes the foundation for protocols to unify liquidity pools through omnichain messaging, providing secure and reliable data feeds for each asset in the pool.

Developers no longer have to manage various infrastructure services—we've already done the heavy lifting behind the scenes and provide a unified interface for exchanges like Jupiter to use. Beyond availability, our price feeds ensure reliability even in extreme situations. Our data is collected from multiple sources, aggregated at defined time intervals, and outputs the Volume Weighted Average Price (VWAP) based on the aggregated data, providing accurate data to dApps.

Assuming Jupiter could obtain all the data feeds they need, the key issue to maintaining the stability of a unified liquidity pool is balancing the distribution of individual pools. Our Photon Messaging inherently enables the withdrawal of liquidity from one pool and its transfer to another blockchain for rebalancing. This process ensures that liquidity pools across multiple blockchains remain balanced, enhancing the stability of DeFi protocols and providing users with consistent access to liquidity, regardless of the blockchain they use.

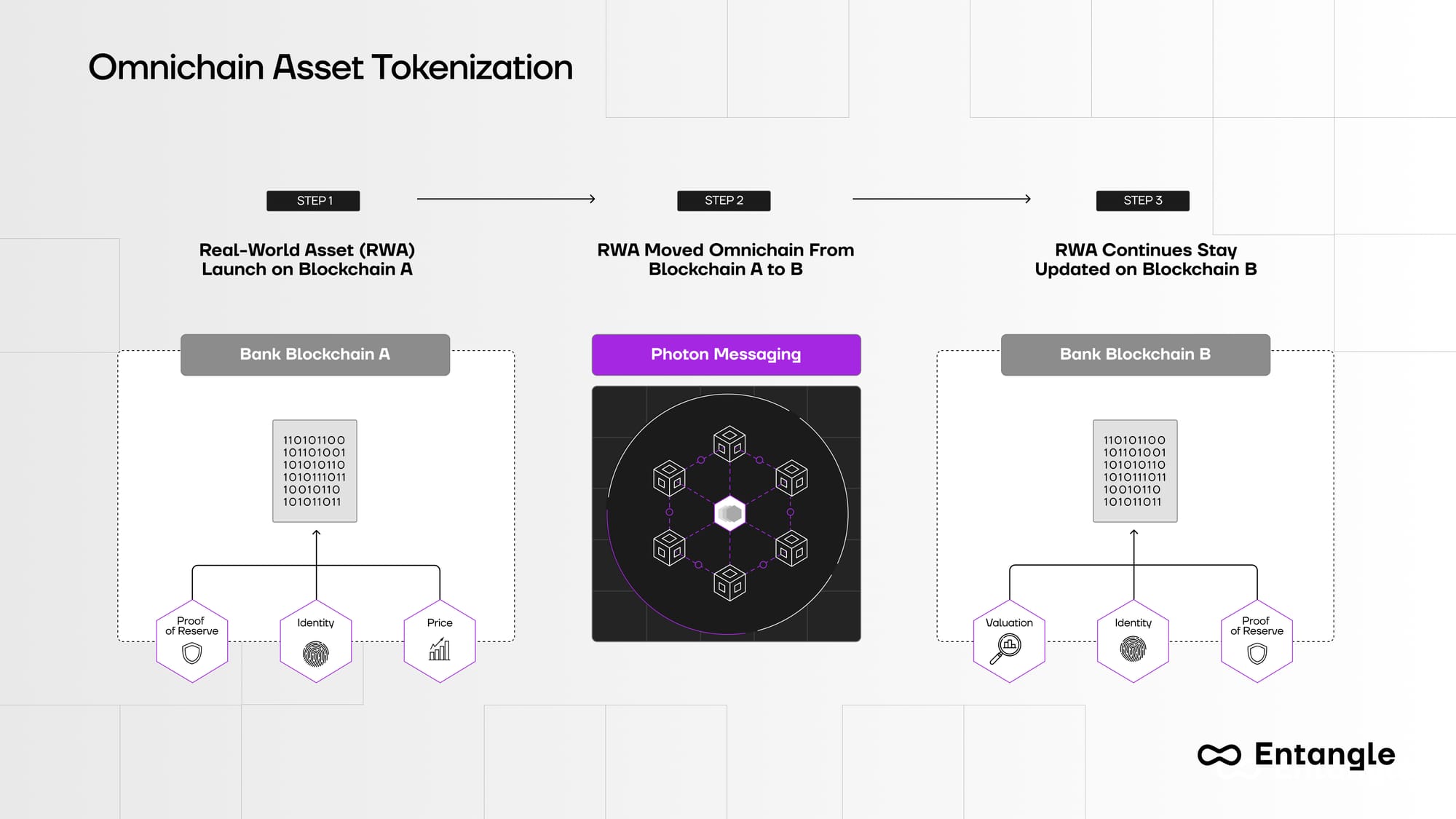

Native Asset Deployments on Any Chain

The ability to deploy native assets on any chain opens new possibilities for asset management and distribution. Protocols can leverage the strengths of different blockchains, deploying assets where they are most effective while maintaining interoperability with other networks. This flexibility is crucial for the growth and adoption of native Web3 applications, facilitating the mass onboarding of users.

Take $PEPE as an example, currently deployed on Ethereum. However, meme tokens on Solana are highly in demand. If $PEPE had been deployed both on Ethereum and Solana from the beginning as native ERC20 and SPL tokens, its traction and price movement might have significantly increased.

The technical burden for developers lies in deploying native assets across chains and managing them in the future. New builders must deploy different contracts on different chains, with no feasible way to deploy tokens with a single click. This forces developers to spend considerable time and resources before launching omnichain tokens.

However, this is not the case with Entangle's solution. With the Photon Messaging protocol, the $PEPE team could directly set the parameters of native assets and easily deploy them on Ethereum and Solana. For instance, they could distribute 60% of the 420T tokens on Ethereum and 40% on Solana while setting the max supply on each chain to 420T.

Our solution supports not only the deployment but also a bridgeable token system. Compared to the existing mint-to-burn mechanism, our approach does not involve wrapped assets. For example, if the price of $PEPE is higher on Solana, one could bridge ERC20 $PEPE to Solana to arbitrage. Entangle would burn the native ERC20 $PEPE on Ethereum and mint the same amount of native SPL $PEPE on Solana. The advantage of this solution is that it ensures both flexibility and security in asset transfer and management, paving the way for a unified blockchain ecosystem where assets and information flow freely across various networks.

Compared to the native stablecoin $USDC provided by Circle, our approach is more open and inclusive—anyone can leverage our stack to deploy native assets on any chain.

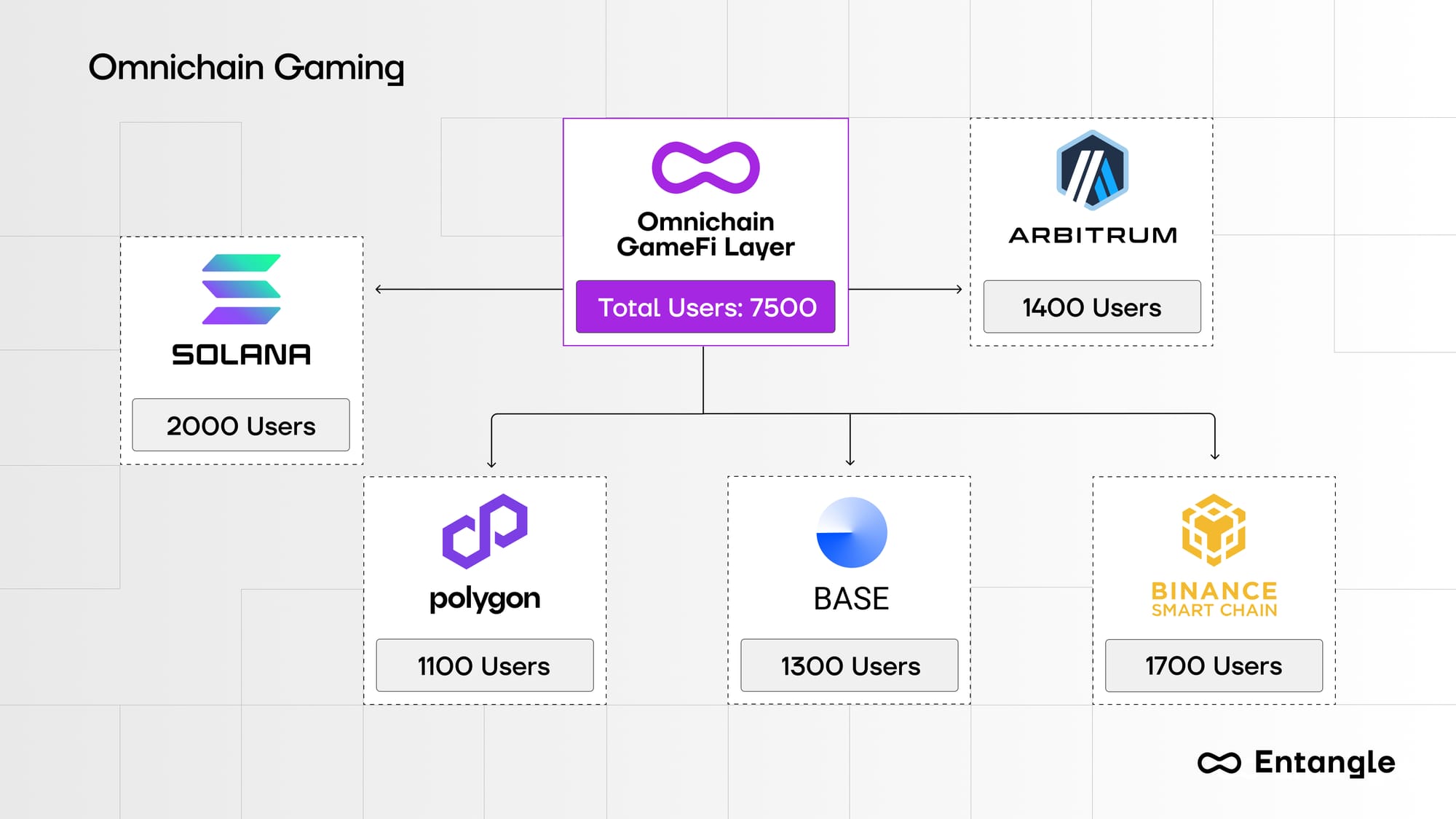

Omnichain Gaming

Gaming is an often underappreciated sector, particularly due to previous Ponzi-nomic designs. However, the interoperability provided by Entangle's solution can unlock numerous possibilities in GameFi, facilitating maximum user capture.

Dark Forest is a well-known, fully on-chain crypto game leveraging zk technology to ensure privacy and verifiability. To upgrade it to an Omnichain game, the most efficient approach is to migrate its assets such as silver and artifacts to omnichain-native assets across different chains such as Solana. This would enhance the liquidity of these gaming assets, enabling them to gain traction and be listed on other marketplaces. Additionally, derivative games could utilize these assets as initial props, thereby shaping the universe of Dark Forest with more gaming LEGO built upon it. Developers can easily utilize our Photon Messaging, as mentioned in the previous section.

Most gaming projects are constrained by the capabilities of single chains. Many developers struggle to build gaming engines like MUD on EVM networks due to the limited capacity of EVM. By separating the gaming engine and gaming logic onto a more powerful chain like Solana, much of the technical burden on developers can be alleviated. The prerequisite is an Omnichain coordination layer that connects these separate parts. This is where our Photon Messaging becomes crucial, acting as the glue to convey messages and not just bridging gaming assets.

Finally, fairness in randomness is a significant concern. Currently, random numbers are generated based on a fixed seed and Ethereum block hash. We can enhance randomness through our e-VRF. Entangle VRF is a reliable and verifiable random number generator designed to provide smart contracts with access to random values without sacrificing security or usability. The authenticity of the random data generated by e-VRF can be verified by anyone by checking the cryptographic proof. Since e-VRF is integrated into Entangle’s Universal Data Feeds and Photon Messaging, developers can easily incorporate more random events in the future, such as weapon drops or attack locations. This not only adds interest to the game but also builds greater trust between games and players.

Moving Forward

These use cases are only some of the few possibilities while utilizing the Entangle infrastructure to inspire developers. With Solana's integration, many novel applications could be built. We expect more developers to join us on this exciting journey, building a future where blockchain technology is truly interconnected and accessible to all.

For more information and updates, visit our website, follow us on Twitter, and join our community on Discord.