The Blueprint For Real World Asset (RWA) Innovation

Founders Edition. Learn more about how Entangle is positioning itself to be the go to solution for Real World Assets (RWA).

Founders Edition

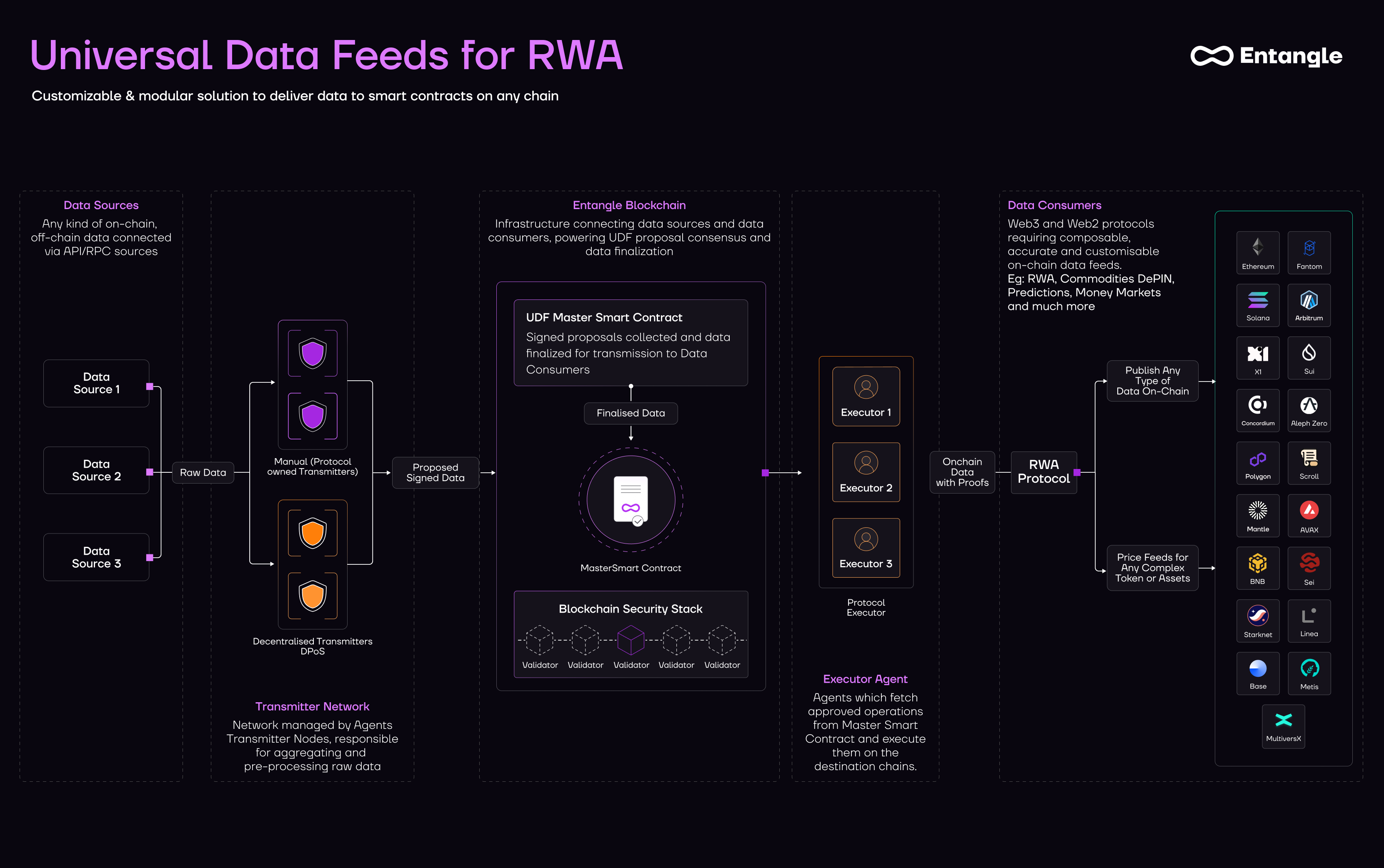

Entangle provides essential infrastructure for powering the security, data, and movement of tokenized real-world assets (RWAs) on-chain. This robust solution includes a suite of tools to ensure both issuers and assets are secure, while maintaining high levels of decentralization. It ensures universal data can be delivered to any smart contract with custom logic, including intervals, fees, and critical aspects like circuit breakers.

Entangle's solution accelerates time-to-market by leveraging scalable infrastructure for any class of tokenized assets on any blockchain. Issuers can access greater liquidity with seamless omnichain availability, connecting their protocol with the entire economy of on-chain and off-chain assets. Entangle enables any type of real-world asset and business to transition on-chain, providing critical components with a highly mobile decentralized data solution for proof of reserves (off-chain), authentication, encryption, and time-stamping of data on Entangle’s Interoperable Blockchain (Merkle Tree). This caters to customized logic and fees, allowing for essential functions such as circuit breakers.

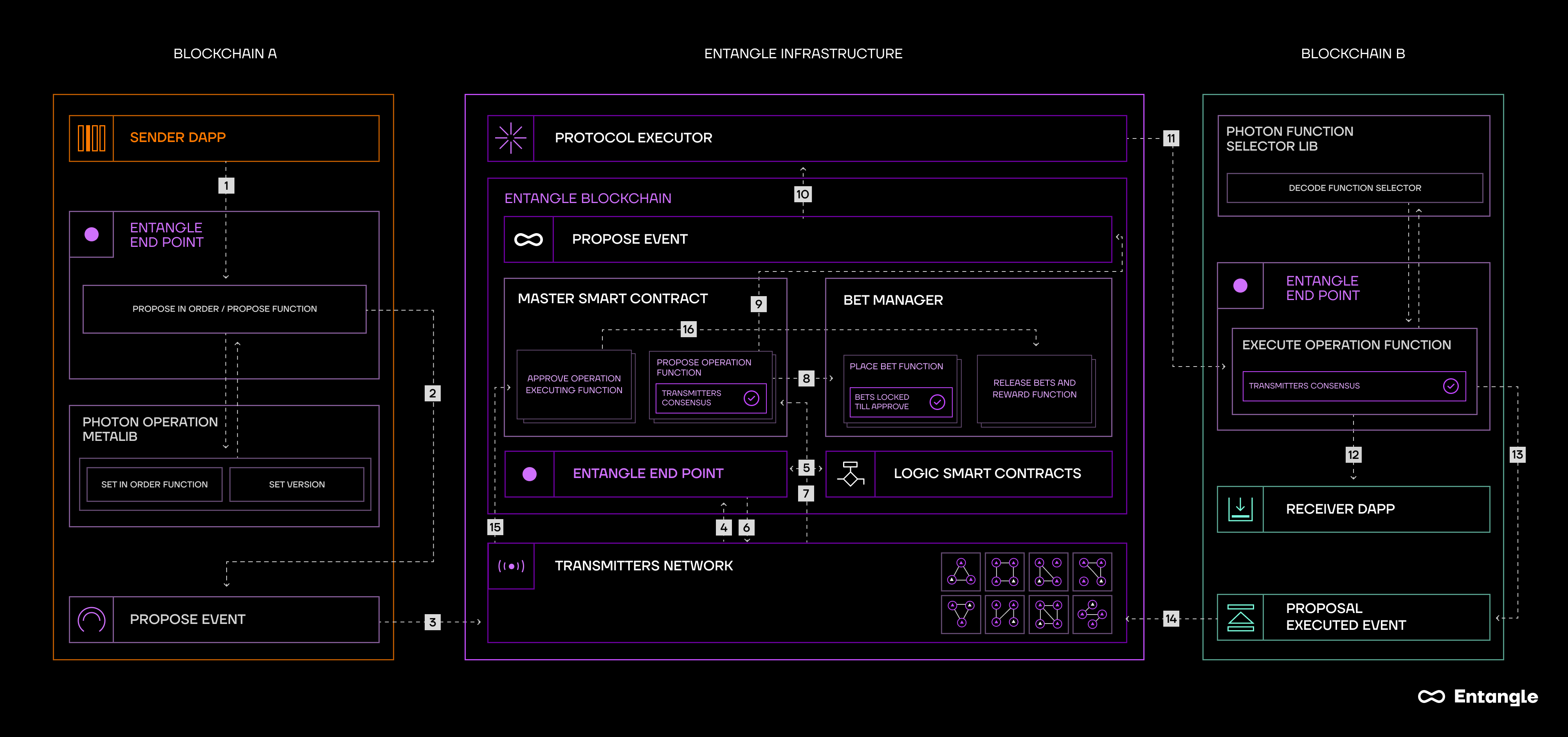

The system architecture includes three major components: the Universal Data Feeds Protocol, Photon Messaging, and Entangle’s Interoperable Blockchain.

An Example Overview of the Entangle Infrastructure with Two Blockchains

What is Photon Messaging?

Photon Messaging is a nexus of smart contracts and libraries across every blockchain. Data is transported to and from these using Entangle's highly customizable proof-of-stake agent network.

What is Entangle's Interoperable Blockchain?

This interoperable blockchain allows for cost-efficient storage and processing of data. It utilizes a highly modified Cosmos Tendermint framework as the medium base for information processing before delivery to destination chains.

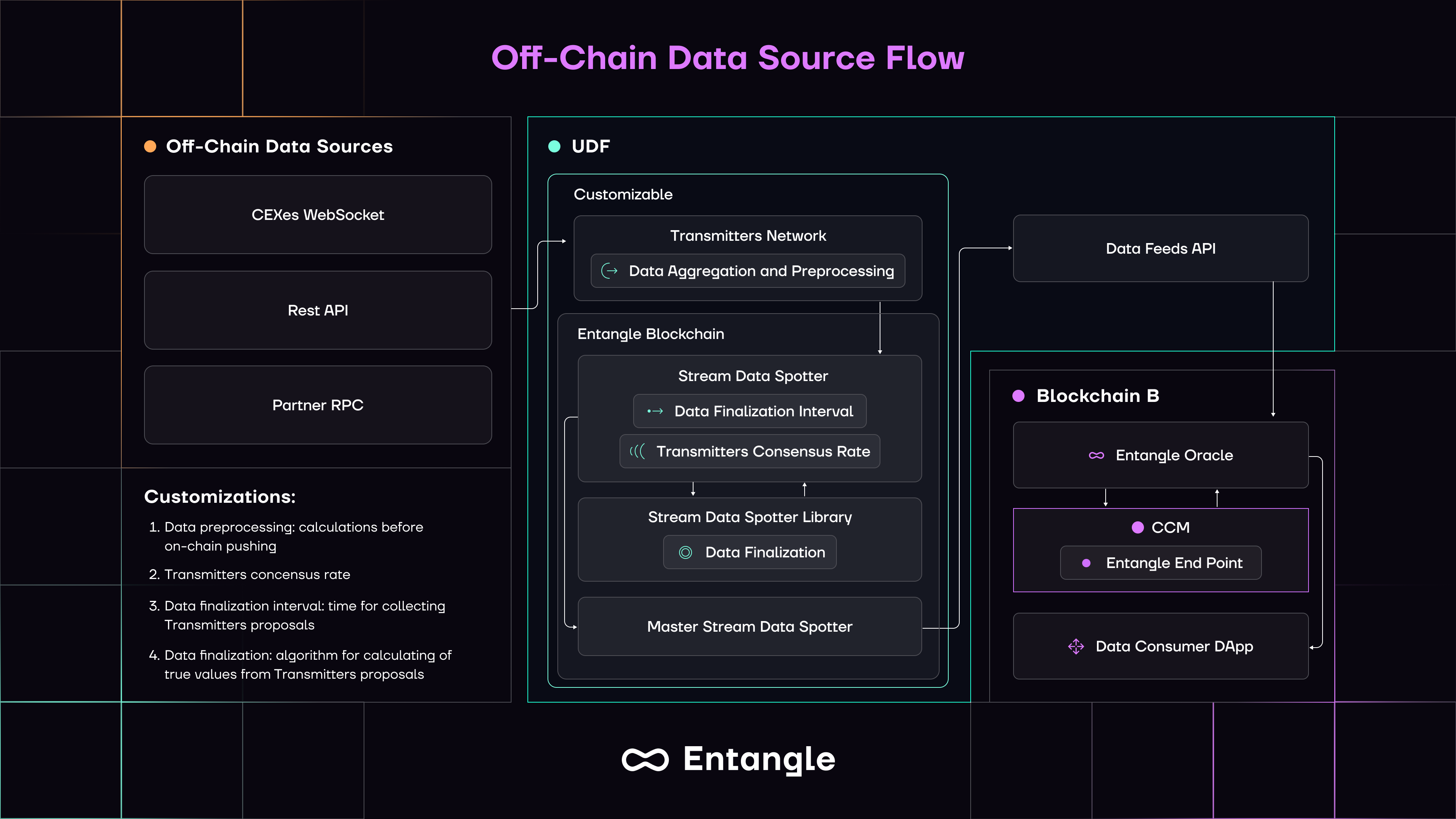

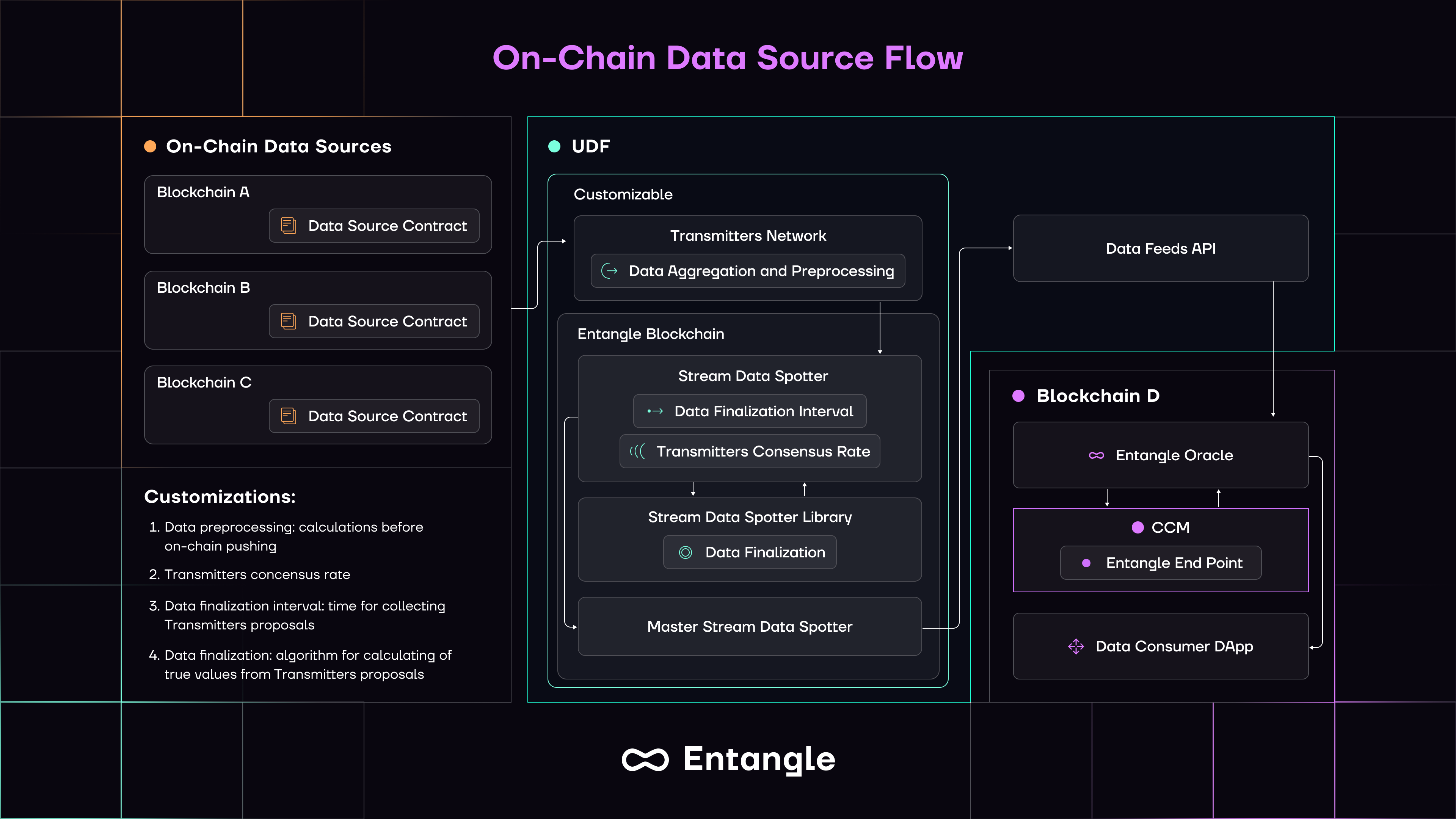

What are Universal Data Feeds?

Universal Data Feeds is a blockchain oracle framework designed to collect, aggregate, and deliver high-fidelity data to on-chain and off-chain users with custom logic capabilities. It aggregates prices from a wide range of sources, ensuring that the outgoing data is accurate, timely, and reflective of current market conditions.

Why Do Issuers Need Customizable and Configurable Data?

From an issuer's perspective, having full modularity and flexibility on data types transported on-chain, while maintaining the ability to monitor data, is crucial. Entangle's highly customizable and modular data feeds offer the following advantages:

- Quick Integration: Build adaptors for integrating with the Entangle agent network through supported APIs to seamlessly incorporate data from any off-chain source, including stock market feeds, foreign exchange market data, commodities, and more.

- Modular Architecture: Supports a wide range of data types beyond just price data, enabling decentralized applications to access comprehensive data, enhancing functionality, and expanding use cases across multiple industries.

- Simple Setup: Developers can set up a simple adapter connected to an API or readable data source.

- Customizable Consensus: Transmitter agents can have configurable consensus settings, such as requiring votes from a certain number of agents to achieve consensus.

- Issuer-Owned Agents: RWA issuers can set up their own agents or combine them with Entangle agents (KYB’d) for data collection, verification, and authentication.

Issuer-Owned Transmitter Agents

RWA issuers can elect to set up their own agents as standalone systems or in combination with Entangle agents (KYB’d) to participate in the data collection, verification, and authentication process.

- To set up an Agent, individuals must complete a KYB process, stake $NGL, and register their Transmitter's address. Agents can boost their selection chances by encouraging delegators to stake their NGL tokens with them. Upon successful participation, Agents can claim their rewards for their contributions. A more detailed guide can be found here.

In many circumstances, issuers may not want to entrust the entirety of data collection validation to a third-party-owned oracle solution or a centrally operated oracle solution. As regulations evolve, participating in data collection at the source is crucial for issuers. Within the Entangle infrastructure, issuers can set up their own agents or use a combination of Entangle agents and their own when connecting to the source data.

Entangle’s Interoperable Blockchain as the Middleman

“When playing piggy in the middle, the middle man keeps both sides in check. Without the pig in the middle, there is no piggy in the middle.”

Current market solutions often fall short by delivering data from external sources to source chains without verification in between. This is akin to mail being collected from your home and posted without sorting, addressing, or security checks. Entangle provides an on-chain hub for authenticity and data immutability before the destination smart contract receives the data.

Key Advantages Include:

- On-Chain Station for Validation & Immutability: Ensures authenticity and data immutability before the destination smart contract receives the data.

- Modified Cosmos Chain: Utilizes a highly modified Cosmos chain with the battle-tested Tendermint consensus algorithm and 100 independent decentralized validators.

- Decentralized Validation: Unlike centralized oracle solutions, Entangle provides a specialized chain for data validation and efficient storage, timestamping, and subsequent delivery of data to the target chain. This is done in a secure manner using Merkle proofs to prevent any alterations to the original data during delivery.

- Time-Stamping: Data is time-stamped prior to delivery to the destination chain, ensuring accuracy and reliability.

- Custom Data Logic: The blockchain is used to apply logic to the data, including fee calculations and other variables, before the final value is delivered to the destination chain. This includes breaker logic for handling black swan events.

- Smart Contract Launchpad: Features Ethermint for launching smart contracts in Solidity on Entangle’s blockchain, enabling a wide range of use cases.

- Automation of dApps: Issuers can automate their decentralized applications (dApps) across any EVM and non-EVM blockchain, including omnichain tokens and liquidity pools.

Interoperability, Composability, and the Future

Entangle is revolutionizing the way yield-bearing tokens and real-world assets (RWAs) interact with the blockchain. One of its standout innovations is the development of Collateralized Derivative Tokens (CDTs), as demonstrated with Trillion. This breakthrough allows the creation of CDTs on yield-bearing tokens such as LP Tokens, restaked tokens, and RWAs, providing transferability, composability, and utility to these assets. Entangle offers methods for token interoperability through synthetic replication (CDTs) and omnichain fungible tokens by leveraging its Photon Messaging layer, enabling easy adaptation of smart contracts for cross-chain transport.

Future advancements in Entangle’s Fungible Token Standard aim to enhance functionality and integration. With Trillion’s goal of creating omnichain CDTs, confirming collateral lock on one chain to enable borrowing on another, significantly expands the possibilities for RWAs.

Entangle’s blueprint for RWAs is comprehensive accounting for current and upcoming regulatory standards for issuers going on-chain. For these reasons, Entangle's approach to RWAs epitomizes the ideal blend of adaptability, innovation, and regulatory compliance, making it a standout solution in the blockchain industry.

This approach for RWAs is the perfect match for the today and future blockchain needs—unparalleled in its adaptability, cutting-edge technology, and innovation.