Impact of RWA's in DeFi: Part 2

- Why is on-chain RWA one of the most important milestones in DeFi?

- How will RWA reshape the DeFi landscape?

- What will RWA adoption change for us: DeFi users and builders?

- Which protocols should we follow for the RWA narrative?

—————————————————————————————

As DeFi grows, developers are adding more and more new building blocks that are necessary for creating a new, accessible and beneficial financial system. In recent months, particular attention has been paid to RWAs as a potentially game-changing direction for DeFi. Read the first article about the impact of on-chain RWA in DeFi, talking about Treasury Bills, Private Credit Investments and Real Estate,

Outlook on the current state of RWA

To see why this could truly transform the state of affairs and help take the next big step in the development of the global financial system, it is necessary to understand what the RWA sector entails and assess it in the context of DeFi. What you should know:

— The market for tokenized commodities is poised for considerable growth, with predictions stating that the total market value of tokenized assets could exceed USD 10 trillion by 2030 [1]

— According to Allied Market Research, the global intellectual property management market was valued at $8.6 billion in 2022, with projections of reaching $37.7 billion by 2032, indicating a significant growth potential for IP-related assets on the blockchain.[2]

— Expert Market Research highlights the global supply chain finance market's size, which was approximately $6.96 billion in 2023, and is projected to grow at a CAGR of 8.7% between 2024 and 2032, reaching a value of $14.74 billion by 2032.[3]

— The market capitalization of gold-backed tokens, which are cryptocurrencies pegged to the value of gold, reached $1 billion as of March 2023. This represents a substantial 60% growth, primarily driven by PAX Gold (PAXG) and Tether Gold (XAUT), each token representing one troy fine ounce of gold.[4]

— Price and Market Capitalization of Gold: At the same time, the price of gold was $2,012 per ounce, and the estimated total market capitalization for gold stood at $12.78 trillion, indicating the vast market size available for tokenization and integration into DeFi platforms. [4]

— Companies in the supply chain finance sector are increasingly focusing on technological innovations. For instance, the introduction of AI-based platforms, such as IBSFINtech's VNDZY, is streamlining the process and offering more comprehensive solutions that connect corporations, suppliers, and financial institutions [5]

Each of these facts highlights the burgeoning intersection of DeFi with traditional asset classes, offering a glimpse into a future where finance is more integrated, accessible, and efficient.

How Real World Assets Fit the On-Chain Economy?

Let’s delve into the potential impact of bringing Real World Assets (RWAs) such as Commodities, Supply Chain Finance and Intellectual Property (IP) onto the blockchain.

Commodities

Commodities, from gold to oil, are foundational assets in traditional finance that provide not only a hedge against inflation but also serve as essential inputs for various industries. The tokenization of commodities translates physical assets into digital tokens, representing ownership or a claim to a portion of the underlying commodity.

Problems solved on-chain:

- Illiquidity in physical commodities: Tokenization enables commodities to be traded on DeFi platforms, providing liquidity and price discovery without the need for physical delivery.

- Access barriers: By fractionalizing ownership, DeFi allows retail investors to participate in the commodity markets with lower capital requirements.

- Market efficiency: The transparency and immutability of blockchain streamline commodities trading, reducing the potential for fraud and manipulation.

Use cases for tokenized Commodities:

- Collateralization for DeFi products: Commodities can be used as collateral in DeFi lending platforms, enhancing the diversity and stability of the collateral pool.

- Synthetic assets and derivatives: Smart contracts can create synthetic commodities or derivatives, allowing for complex financial products without the need for physical commodities.

- Commodity-Backed Stablecoins: can be minted, with each stablecoin representing a claim on a portion of a tokenized commodity. This can provide a stable medium of exchange that is backed by real-world assets rather than fiat currency.

- Tokenized Commodity Indexes: Similar to traditional finance, where commodity indexes track a basket of commodities, DeFi can offer tokenized versions of these indexes, allowing investors to gain exposure to a diversified set of commodities through a single investment.

- Provenance Verification: Blockchain can track the entire lifecycle of a commodity, reassuring buyers of its authenticity and ethical sourcing.

Protocols to look at:

- Synthetix — allows the creation of synthetic assets, including those that track the price of real-world commodities. Users can trade synthetic commodities on Synthetix without holding the actual physical asset.

- TokenSets — there are sets that can include tokenized commodity assets. These sets operate as tokenized investment portfolios, which can be programmed to follow certain management strategies based on commodity prices.

- Paxos Gold (PAXG) — a gold-backed cryptocurrency that is directly tied to the price of gold. Each PAXG token represents a certain amount of physical gold, and the token can be used within the DeFi ecosystem for lending, borrowing, and as collateral.

- Bru Finance — India’s largest asset tokenisation platform. It enables commodity-backed bonds that are linked to the price movements of underlying commodities. The value and interest payments of these bonds fluctuate based on the price of the commodities they are backed by.

Supply Chain Finance

Supply Chain Finance helps businesses free up capital and reduce the risk of supply chain disruptions by financing certain parts of the supply chain.

Problems solved on-chain:

- Slow and opaque transactions: Blockchain enhances transparency and speeds up transactions in supply chain finance, benefiting all parties involved.

- High transaction costs: Smart contracts can automate many of the processes in supply chain finance, cutting down on paperwork and middlemen, thus reducing costs.

- Credit access: DeFi can provide more democratic access to financing for small and medium-sized enterprises (SMEs) that traditionally have less bargaining power.

Use cases for on-chain Supply Chain Finance:

- Smart contract automated payments: Upon meeting predefined conditions, smart contracts can automatically release payments to suppliers.

- Tokenization of invoices: Invoices can be tokenized to facilitate their trading, providing liquidity to suppliers.

- Transparent auditing: The blockchain provides an immutable ledger, simplifying auditing and due diligence for financiers.

Protocols to look at:

Tradeshift Cash — is a platform that offers supply chain payments and marketplaces. With Tradeshift Cash, companies can use blockchain to gain early payment on their invoices, which provides immediate liquidity. While not a traditional DeFi protocol, Tradeshift Cash incorporates some elements of DeFi by using blockchain to decentralize access to finance and improve the efficiency of transactions.

Intellectual Property (IP)

IP represents a wide range of intangible assets — from patents and trademarks to copyrights and trade secrets. Traditional management of these assets often involves complex legal frameworks, significant administrative overhead, and a relatively illiquid market for trading and leveraging these assets for value.

Problems solved on-chain:

- Inefficient IP Transactions: Blockchain can streamline the process of buying, selling, and licensing IP, reducing paperwork and expediting transactions.

- Opacity in Ownership and Rights: On-chain tokenization of IP can bring clarity to ownership rights, history, and validity, making it easier to verify and transfer IP assets.

- Barrier to Monetization: By fractionalizing IP assets, blockchain enables creators to monetize their work through partial sales or investment without relinquishing full control.

Use cases for tokenized IP:

- Transparent Royalty Distribution: Smart contracts can automate royalty payments, ensuring creators are paid fairly and promptly for the use of their IP.

- IP as Collateral: Tokenized IP can be used as collateral in DeFi lending platforms, allowing creators to secure funding based on the value of their IP.

- Licensing and Rights Management: Blockchain platforms can facilitate the licensing of IP, with smart contracts enforcing terms and automating compliance.

- Marketplace for IP: Creation of decentralized marketplaces where IP can be bought, sold, or traded, similar to NFT marketplaces for digital art.

- Innovation in Financing: New financial products can be developed around IP assets, such as IP-backed loans, or funds that specialize in investing in tokenized IP.

Protocol to look at:

IPwe — is a platform that utilizes blockchain and AI to create a marketplace for IP, enabling IP transactions and licensing. The platform aims to simplify the process of managing IP rights, making it easier for inventors and creators to protect and monetize their work.

By integrating RWAs like Commodities, IP, and Supply Chain Finance on-chain, DeFi can address key issues in TradFi by providing enhanced liquidity, lower entry barriers, and improved transactional efficiency, while also creating innovative use cases for these asset classes.

A look into the future

Incorporating Real World Assets (RWAs) such as Commodities, Intellectual Property, and Supply Chain Finance into decentralized finance (DeFi) offers a range of benefits that enhance both traditional and decentralized financial ecosystems:

For Business and Traditional Finance:

- Enhanced Asset Liquidity: The tokenization of gold and oil, patents, and receivables can turn these assets into more readily traded securities, offering greater liquidity and opening up new investment frontiers.

- Streamlined Operations: Smart contracts can automate royalty payments for creators, enforce commodity trade agreements, and facilitate quicker settlements in supply chain transactions, significantly simplifying operations.

- Expanded Market Access: A farmer in Uganda can access the same financial instruments for their coffee crops as a trader in New York, while a local artist can sell IP rights globally, and a small manufacturer can easily engage in cross-border trade finance.

For the DeFi Ecosystem:

- Capital Influx: By incorporating asset-backed tokens, such as gold-backed cryptocurrencies, tokenized patents, or digitized invoices, DeFi can tap into new capital sources, bolstering the ecosystem's growth.

- Broader User Adoption: Traditional investors more comfortable with tangible assets like precious metals, recognizable IPs, or trade finance instruments may find DeFi platforms more appealing, easing their transition into this new financial landscape.

- Collateral Diversity: With RWAs, DeFi protocols can offer loans against a wider range of collateral, from metal reserves to royalties from streaming music services, to prepaid contracts in the supply chain.

For Users and Builders:

- Innovative Product Offerings: DeFi can facilitate novel financial products, such as fractional ownership in a famous painting, shares in a patent pool, or investment in a supply chain financing fund.

- Flexible Yield Strategies: Investors can earn yields from real-world economic activities, whether through staking in a pool backed by agricultural commodities, investing in a fund of pooled IP assets, or participating in invoice factoring operations.

- Sustainable Financial Solutions: Refinancing options for RWAs in DeFi, like turning warehouse stored grains into tradeable assets or leveraging a portfolio of patents for liquidity, can provide stable and ongoing funding mechanisms.

The integration of RWAs into DeFi is not just a convergence of worlds but an expansion, creating a more versatile, accessible, and resilient financial system. For stakeholders, this means engaging with a market that values real-world economic activities as much as it does digital innovation, paving the way for a financial future where traditional and modern finance coalesce.

What’s the Entangle contribution to the RWA adoption?

Entangle’s contribution to the RWA adoption on-chain is significant for the integration of Commodities, Intellectual Property, and Supply Chain Finance. As a versatile data infrastructure, it bridges the gap between traditional financial sectors and DeFi, enhancing the utility and efficiency of these assets on the blockchain.

Contribution to Commodities

In the Commodities market, Entangle introduces groundbreaking enhancements providing reliable, custom real-time data streams to access commodity prices in the fastest, cost-efficient manner. This capability is crucial for commodities whose prices are highly volatile and subject to rapid changes due to market sentiment, geopolitical events, or natural disasters. With Entangle, the representation of tokenized commodities in DeFi can be adjusted in real-time, enabling accurate and fair trading and novel use cases. Additionally, Entangle will manage complex trade agreements and settlements for commodities, further reducing reliance on slow traditional systems.

Contribution to Intellectual Property

For Intellectual Property, Entangle’s architecture offers a transformative approach by securely channeling IP-related data into the blockchain environment. It allows for the tokenization and trading of IP rights, ensuring that creators can monetize their assets while maintaining control over their work. Entangle will automate royalty payments based on actual usage data, fostering an environment where intellectual property can be easily licensed and managed. This automation ensures that IP owners are compensated accurately and efficiently, which is often a challenge in the traditional IP marketplace.

Contribution to Supply Chain Finance

In Supply Chain Finance, Entangle acts as a catalyst for innovation by facilitating the on-chain representation of financial instruments related to the supply chain. It enables the digitization of invoices and other receivables that can be used as collateral, enhancing liquidity for businesses. By utilizing Entangle, companies can gain access to capital more quickly and at lower costs than traditional financing methods allow. Moreover, Entangle’s infrastructure can track the provenance and authenticity of goods through the supply chain, providing transparency that is invaluable for financiers and insurers alike.

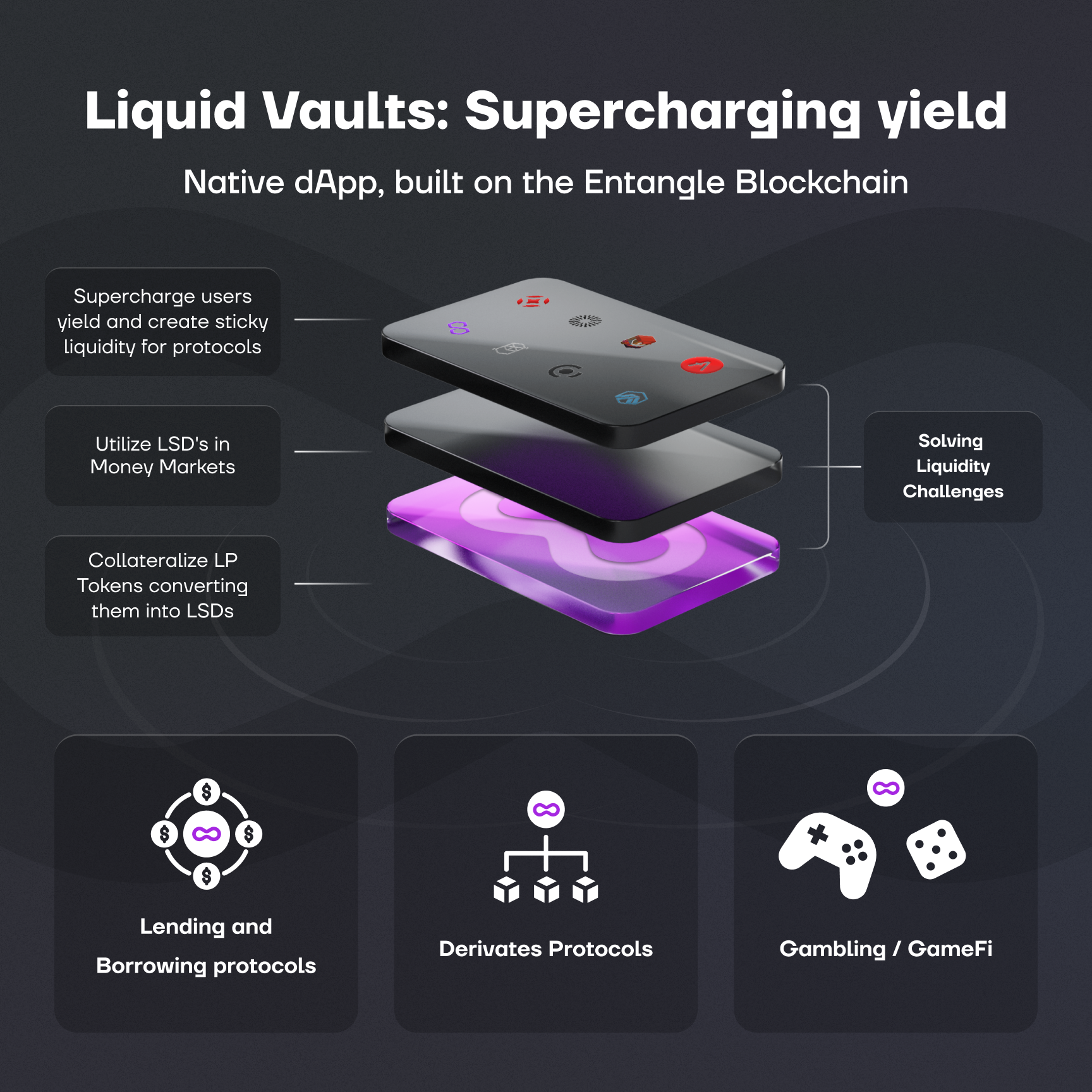

Entangle and its native DApp Liquid Vaults empower these sectors by providing secure, decentralized, and cost-effecient solutions for tokenization, communication and scalability of Real World Assets on-chain. This capacity to tailor security parameters for each sector’s unique needs significantly advances the adoption of RWAs in DeFi, ushering in a new era of financial inclusivity, innovation and capital efficiency. Stay updated

About Entangle

Entangle is the first customisable & interoperable data infrastructure built for Web3 and Institutions. It resolves smart contract communication, liquidity and scalability challenges. Join unified Web3 Ecosystem with Liquid Vaults DApp, Photon Messaging Protocol, Web2 Connectivity and Custom Price Feeds.

Follow us: @EntangleFi | Learn more: Website | Join the community: Discord