Unlocking Decentralized Assets 🌎

As DeFi accelerates, bridging traditional finance and its decentralized counterpart becomes crucial. We’ll explore how Liquid Vaults and the Entangle Oracle Solution are innovatively blending legacy finance structures with DeFi protocols, setting new industry benchmarks.

The Unique Utilities of Traditional Assets

Traditional assets have long been known for their versatility and multifaceted utility. For instance, assets such as real estate, equities, or government bonds not only provide potential returns but also serve pivotal roles in collateralization. This multiplicity in function allows them to be securitized, traded, or used as collateral in lending and borrowing practices, giving them a unique position in financial systems.

The Utility Challenge in Crypto

Contrarily, while the Web3 is ever evolving, many crypto assets, especially liquidity provider (LP) tokens, still remain underutilised. Although they represent a stake in a liquidity pool and can earn fees, their use-cases are often limited. Their full potential isn't realized, especially when compared to the robust utility spectrum of traditional assets. This void in utility limits capital efficiency and, in many cases, creates barriers for new entrants into the DeFi space.

Liquid Vaults: The Game Changer

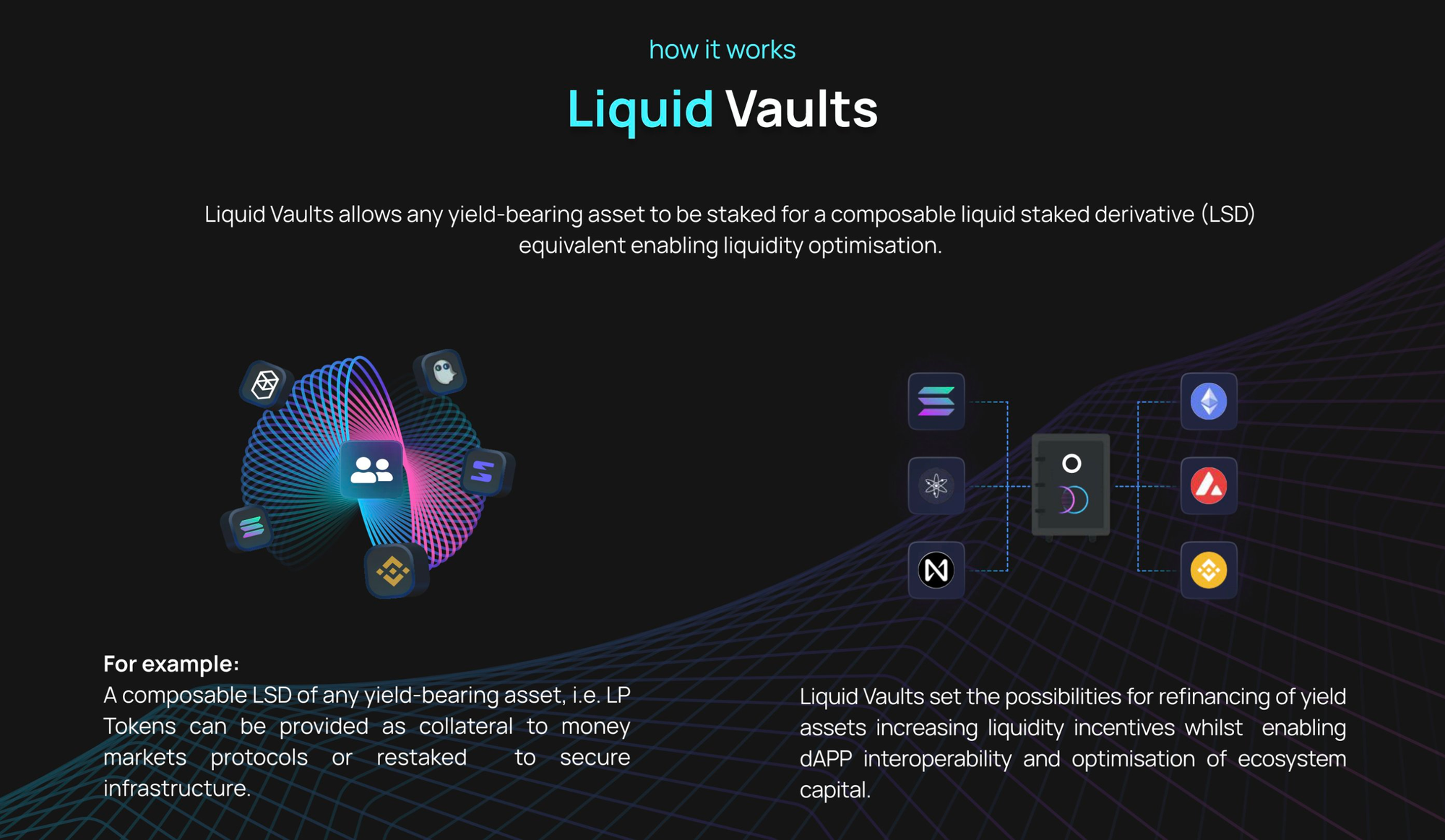

Enter Liquid Vaults. Serving as the keystone of Entangle's platform, Liquid Vaults are a testimony to what is achievable when innovative DeFi solutions are applied thoughtfully.

Interoperable Liquidity Layer

Entangle's oracle and customisable blockchain provide an interoperable foundation for Liquid Vaults. This translates to seamless, cross-chain liquidity, paving the way for unmatched capital efficiency.

Unlocking New Use Cases with LSDs

Liquid Vaults facilitate the creation of Liquid Staking Derivatives (LSDs). These LSDs, born from staking idle LP assets, are versatile tools in the DeFi toolkit. Whether it's tapping into money markets, option protocols, or enhancing infrastructure, the possibilities are endless.

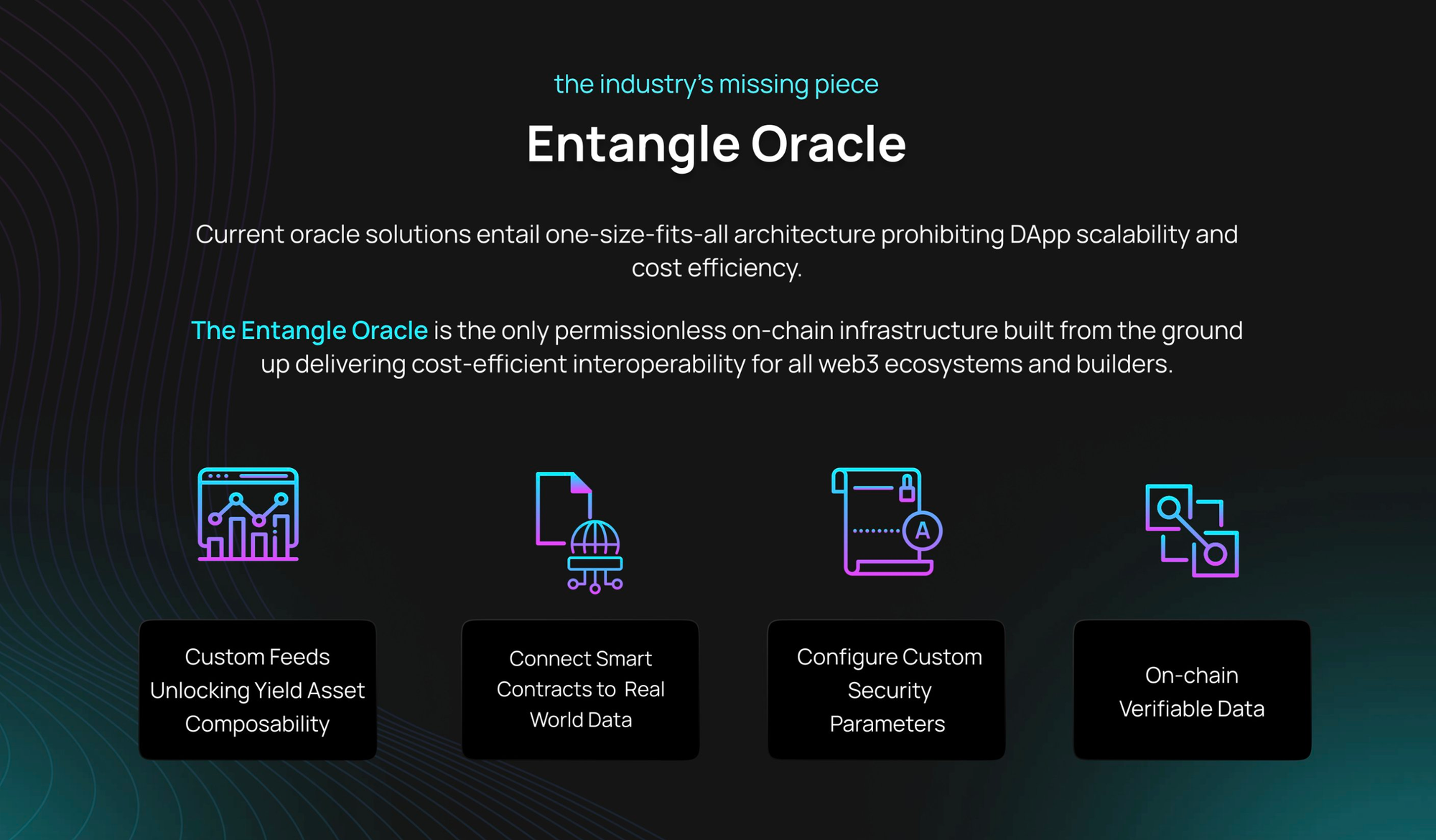

Oracle & Blockchain Solution

The Entangle Oracle ensures on-chain data storage and event verifications, slashing costs and increasing efficiency. Simultaneously, the specialized Entangle blockchain serves as a bedrock for information storage and oracle message validation.

Boosting Yield Strategies

Entangle's ecosystem allows DeFi enthusiasts to maximize their yield. By synthesizing idle LP assets, they can be compounded, staked, and transformed into LSDs. These LSDs can then dive into lending protocols or other secondary protocols, unleashing enhanced capital efficiency and sticky liquidity for partner decentralized exchanges.

Drawing inspiration from traditional finance, especially in the verticals of leverage, securitisation, and collateralisation, Entangle is setting benchmarks in how liquidity should be structured in DeFi. By offering compelling incentives and innovative solutions, Entangle not only addresses existing gaps but also lays down the foundation for mass adoption in decentralized finance.